Despite the focus on crypto’s volatility, its long-term lack of correlation with major asset classes like equities, fixed income, and commodities, is often overlooked.

Understanding how different assets interact is essential to building resilient portfolios, as their relationships can significantly impact overall risk and return. The role of correlation in portfolio diversification is clear: lower correlation means less risk and reduced overall portfolio volatility. If cryptocurrencies show little to no multi-year correlation—or even negative correlation—with other assets in a portfolio, they could help lower portfolio risk through diversification. On the other hand, if they’re strongly correlated, adding crypto might work against diversification goals.

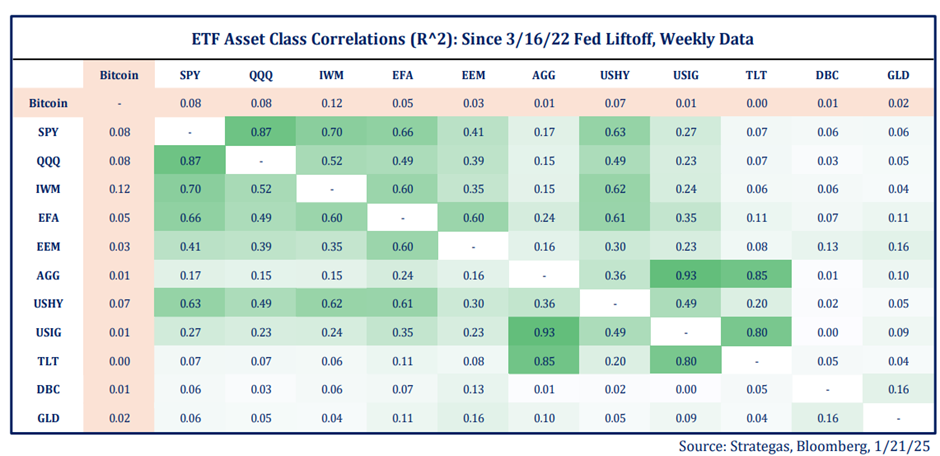

Since the Fed started increasing rates in March 2022, bitcoin has had very weak, almost zero, correlation with major asset class ETFs, as shown below. As expected, bitcoin is uncorrelated with fixed income and commodity ETFs, and mildly correlated with small caps and the Nasdaq ETFs. On the other hand, correlations within the ETFs themselves were much higher.

As concentration risk in broader indices grows, crypto assets could provide meaningful long-term diversification benefits, if appropriately allocated. This is especially likely under the current US administration’s pro-crypto policies, as crypto assets are increasingly driven by independent fundamentals — prices may respond more to regulatory approvals and adoption catalysts like ETF approvals than to tech-sector-specific trends.

Data from Strategas and Bloomberg as of Jan. 21, 2025. Abbreviations for ETFs: SPY: SPDR S&P 500 ETF Trust; QQQ: Invesco Nasdaq ETF; IWM: iShares Russell 2000 ETF; EFA: iShares MSCI EAFE ETF; EEM: iShares MSCI Emerging Markets ETF; AGG: iShares Core US Aggregate Bond ETF; US HY: iShares Core US Aggregate Bond ETF; US IG: iShares Broad USD Investment Grade Corporate Bond; TLT: iShares 20+ Year Treasury Bond ETF; DBC: Invesco DB Commodity Index Tracking Fund; GLD: SPDR Gold Trust