COMPANIES: Companies remain the biggest net buyer of US stocks. This is a unique market support, as the rest of the world prefers dividends, and is a surprise to many. The number of S&P 500 stock buybacks is cyclically cooling but still huge at $800 billion over the past year. For context, this is fifty times more than the $16 billion raised in IPOs this year. The new 1% net buyback tax, introduced December 31 last year, has had a modest impact so far. But this could be increased in the current 2024 budget negotiations, with earlier Democrat proposals to take to 4%. This could be a tipping point that threatens to undermine this unsung market support.

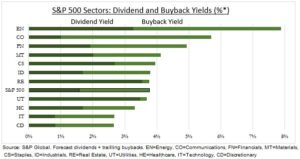

NUMBERS: The combined US buyback plus dividend yield is a chunky 3.8% (see chart). 70% of S&P 500 stocks bought back shares last quarter, totalling $175 billion. This is down 20% from prior. With less bank’s activity and slower economy concerns. Buybacks remain top-heavy with the top-20 stocks making up over half of activity. US companies are unique globally in preferring buybacks near 2:1 versus dividends. This is driven by 1) tax advantages, 2) big employee share plans, 3) widely dispersed shareholder bases, 4) greater payment flexibility vs dividends.

TRENDS: Tech dominates the buyback list, with Apple (AAPL) and Alphabet (GOOG) head and shoulders above others in the scale of their buybacks, of $15-$20 billion a quarter. A notable buyback addition has been NVIDIA (NVDA) with its embarrassment of riches as it leads the AI-boom and earnings outlook tripled this year. Financials comes second, led by Wells Fargo (WF), but have trimmed back buybacks as they face higher regulatory capital requirements. Oil stocks are becoming bigger buyers, reflecting their huge cash flows with oil prices high and capex limited. Exxon (XOM), Chevron (CVX), and Marathon (MRO) are now in the top 10.

All data, figures & charts are valid as of 21/09/2023.