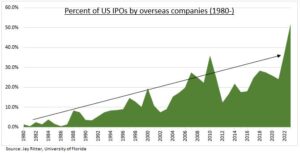

LISTING: There is a booming trend to IPO outside of your home market. These cross-border listings are especially focused on the US (see chart). Seen most recently with the IPO of British headquartered ARM (ARM), indirectly in Vietnam’s VinFast (VFS) SPAC, through to the coming German headquartered Birkenstock. Companies come for the world’s largest investor base and highest valuations, more industry comparables, and sometimes flexibility to have a dual share class. But they also lose the ability to be included in local indices, followed by the booming US$10 trillion ETF industry. And there are disadvantages to being a small fish in a huge pond.

OVERSEAS: The US, but also Switzerland, Hong Kong, and London, have all been attractive IPO venues for foreign companies. Half of US listings in 1H23 were from overseas, an all-time high. Led by companies from China, Canada, and Israel. They come for a bigger investor base that may better understand their business, with more comparable stocks, and often prepared to pay a higher valuation. But it’s not a panacea. A key disadvantage is the non-eligibility for local market indices. The London Stock Exchange (self-servingly) recently warned, for example, that only 4 of the 23 UK company listings in the US in the past decade have prospered. A popular middle-way is a secondary listing of shares abroad whilst keeping a primary home listing.

DOMESTIC: Over 90% of companies decide to list on their local exchange. Where they are incorporated, have their headquarters, often do a lot of business, and are better-known. They also typically qualify for inclusion in the local stock market index. This is increasingly important as the amount of money invested in exchange traded funds (ETF) tops $10 trillion. Markets like the UK have been wracked by self-doubt as companies have decided to list in the US. This ignores a longer trend of many emerging market and overseas mining firms listing in London.

All data, figures & charts are valid as of 27/09/2023.