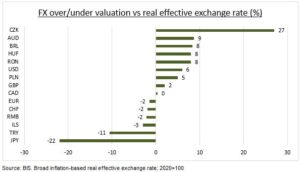

EAST: European currencies have been both some of the world’s strongest, and weakest this year. Eastern Europe has led the way, with the Hungarian Forint (HUF) surging 10% vs the dollar, with Czech Koruna (CZK), Polish Zloty (PLN), and Romanian Leu (RON) not far behind. The region has piggy-backed off the strong EUR and from its own high interest rate differential ‘carry’ after an early rate hike start. It also benefits from its high-beta leverage to the EU’ upside growth surprise, as natgas prices plunged and China reopened. But gains will be tougher from here, with valuations now fuller (see chart). Whilst others like Israel’s Shekel and Turkey’s Lira have suffered from policy uncertainties but have lower valuations and clearer possible catalysts.

ISRAEL: The Shekel (ILS) has a long history of stability and outperformance, with Israel’ current account surplus, huge FX reserves, the Bank of Israel’s (BoI) long standing independence, and usually stable local politics. BoI has a track record of intervening to manage ILS strength when necessary, given the country’s small, open, and trade dependent economy. Similar to the role of Switzerland’s SNB and its Franc (CHF). The Shekel weakened to a four-year low in Q1 with the government’s controversial judicial reform plans that have since been paused but not reversed.

TURKEY: The Lira (TRY) has continued to weaken as the economy suffers from 50% inflation and aftermath of February’ huge earthquake. The central bank has favoured widespread macro prudential measures to manage the FX with interest rates cut to a low 8.5%. Turkey has key presidential and parliamentary elections on May 14th with President Erdogan in a tight race, according to polls, against a united opposition and with Lira one of the world’s cheapest FX’s.

All data, figures & charts are valid as of 18/04/2023