DOW: The Dow Jones Industrials (DJ30) winning streak highlights the healthy broadening of the US stocks rally outside of the ‘magnificent 7’ big tech stocks. To traditional Value stocks, small caps, and the equal-weight S&P 500. With 70% the S&P 500 now above their 200-day moving average. This reflects US economic resilience as the Fed readies its last rate hike. Q2 GDP is set to grow 1.8%, a slowdown from Q1’s 2% but a long way from the feared recession. Whilst 12 straight months of lower inflation leave the Fed able to respond to any sharper GDP weakness with interest rate cuts. We see Value opportunities from healthcare to travel, but think it’s an overall trap without visibility on the GDP trough. Whilst tech-led Growth has more in the tank.

VALUE: We see the attraction of typical Value (IWD) sectors, from banks to commodities, with their very low valuations and unloved status. But do not think they can sustainably outperform if we still have an economic slowdown ahead of us. The steady weakening of the forward-looking global flash PMI’s is a reminder of the weakening growth pace. Global manufacturing is already in recession and the dominant services sector is now slowing. We see select opportunities in healthcare, a Value heavy sector with a combination of defensive earnings, decent growth, and in-line valuation. Or Value segments, like travel, seeing catch-up demand and pricing power.

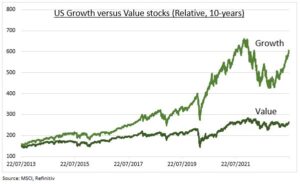

ANATOMY: Value has underperformed Growth (IWF) by a huge 330% the past decade, as tech disruption quickened and low interest rates helped valuations (see chart). The P/E discount of Value (15x) vs Growth (27x) is near the decade high 49% seen at the end of 2021. That was an attractive relative entry point. Holding us back now is the outlook for Growth profits to expand beyond the 15% forecast as cost cutting and AI trends build. Whilst Value is sapped by slowing economies that have taken the earnings growth outlook to -6% and could move further lower.

All data, figures & charts are valid as of 24/07/2023.