NEW YEAR: IT, Communications and the tech-heavy Consumer Discretionary sectors dominate markets. ‘Tech’ represents 43% US equities, and 28% overseas. They performed terribly last year, and a better 2023 is key to markets. Their profits outlook leads S&P 500 weakness as we head into Q4 earnings season. With a double-whammy of demand payback for 2020/1 covid boom and a building cyclical discretionary slowdown. But they have defenses. 1) Profit margins double the market, and often fortress balance sheets. 2) Managements moving fast to cut costs. 3) It’s peak 30% S&P 500 valuation premium gone, and supported by lower bond yields. This is enough to avoid a repeat of the lousy 2022 performance, and support markets. See @BigTech.

INNOVATION: Last week saw the first live Consumer Electronics Show (CES) in two years, with 100,000 attendees and 3,000 exhibitors. CES showcased many of the tech products to hit the shops in coming months (and years). It was a reminder that behind the downdraft in cyclical tech demand and valuations, innovation is strong. Highlights varied from specific; like flying and colour cars, better budget smartphones, Intel 13th gen processors and AMD Ryzen AI chips. To broad; huge number of software and IoT infused products, and AR/VR and Web 3 applications.

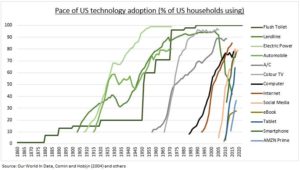

ADOPTION: The backdrop is one of still rapid tech adoption (see chart), with a lot still to come. This has been accelerated recently. By 1) a Covid boost, across ecommerce, remote working home-tech, and biotech. 2) The venture capital (VC) boom, with $75 billion new global funding in Q3. Whilst sharply down from a Q421 peak of $175 billion its up from a pre-pandemic $60 billion. 3) Further cost falls and capacity increases in enabling tech, from chips to the cloud.

All data, figures & charts are valid as of 09/01/2023