The biggest challenge in value investing is not finding cheap companies, it is finding value where others don’t see it. With a 9% growth in 2024, it’s worth analyzing the data reported to see if is a smart decision to have in our portfolios. Given that the industry is currently trading at 30x times, while TeamViewer ($TMV.DE) is trading at 15x we have to give them a look for the opportunities and a chance to prove Mr. Market wrong.

Source: YT RealWear Acquires Almer Technologies, backed by TeamViewer.

Key highlights

- TeamViewer ($TMV.DE) reported a 9% revenue growth in 2024, demonstrating resilience in the remote access market.

- The acquisition of 1E, a leader in Digital Employee Experience (DEX) management, for $720M could strengthen TeamViewer’s enterprise offerings.

- TeamViewer is making bold moves into North America and APAC. Will this be the key to unlocking its next phase of growth?

Business Overview

Teamviewer was founded in 2005 in Germany and was designed to reduce travel time and allow remote tasks on any device. To date, it is installed in nearly 2.5 billion devices, with multinational clients, such as DHL, Coca-cola, Volvo, and BOBST. With 640.000 subscribers worldwide with an impressive retention rate of 100%. Considered the most salient brand among IT professionals for remote connectivity solutions through a TMV brand survey (2021-2024 n=4000-4400 across 5-6 key markets).

Source: Teamviewer Q4/24Y presentation

TeamViewer operates on a subscription-based model across multiple product categories, including:

- Remote Support Solutions – Secure remote access and troubleshooting.

- Enterprise Connectivity Solutions – IT/OT integration for large organizations.

- Digital Employee Experience (DEX) – Enhancing digital workplace efficiency.

- Frontline Productivity Solutions – AR and mixed reality tools for industries.

Through its partnership with RealWear, TeamViewer offers augmented reality (AR) and mixed reality (MR) solutions to optimize operations in manufacturing, logistics, and after-sales services, enhancing productivity and efficiency.

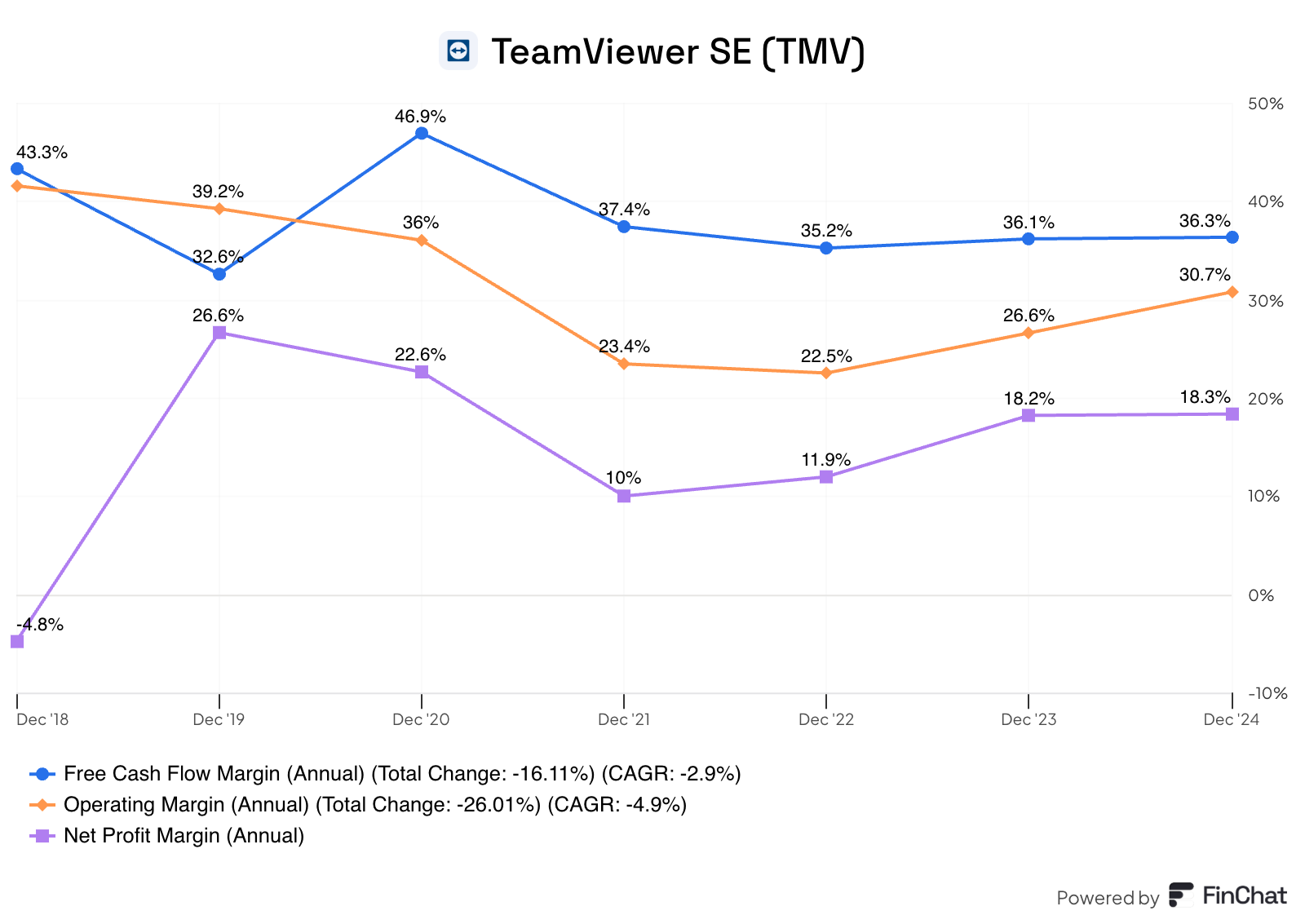

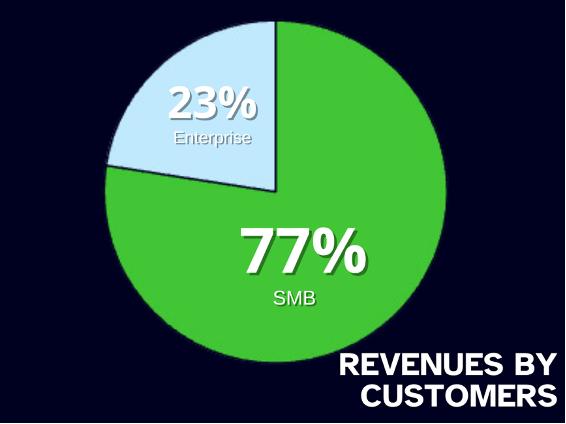

In 2024, TMV reported a revenue growth of 9% (in constant currency), reaching €671.4 Million, being €520M from small and medium businesses, and €151.4M from enterprises, this latest number had a growth of 24% highlighting the strategy where the company is looking for expand. The FCF margin has been sustainable through the years, with a 35% average.

Source: Finchat

The recent acquisition of 1E the company leader in DEX management tool at an enterprise value of USD 720 million, is looking to position Team Viewer as a broad IT/OT services provider. With the integration of both technologies and teams, the combined products are expected to increase the total addressable market and the all-in-one provider.

Additionally, the company is committed to innovating with AI, this year they launched “Session insights”, a feature that automatically summarizes remote support sessions and provides analytics. This feature is now integrated into Microsoft Teams and Copilot.

Looking ahead, to 2030, the World Economic Forum estimated that global digital jobs are going to increase by 25% from 73 Billion to 92 Billion, along with this, companies are seeking more to enhance productivity, which would increase the Total Addressable Market to €22 Billion in 2028 a 13.6% more than today amount, and here is where we can see the reason for the 1E acquisition, TeamViewer’s CEO even described it as “the fastest way of innovation” and this way use the momentum of the tech boom to become the IT/OT all in one platform.

The variety of competitors could go from AnyDesk, LogMeIn, or Microsoft Remote Desktop in remote control, in DEX services, the first competitor is Nexthink, in other services we could mention Connectwise, but the main difference comes, in the ability now for the company to offer several services with just one provider. Large enterprises often prefer to consolidate service providers (even at a premium) rather than managing multiple vendors, which can lead to operational inefficiencies

Investment analysis

Through the strategic plan and mid-term targets, the management expects double-digit revenue growth from 2027 onwards. Supported by the expansion of augmented reality, the revolution with AI in online services, the now ample variety of services offered with 1E, and the opportunities for expansion in North America and APAC. Which makes a TAM expansion to €22Bn a 13.6% increase to 2028.

The business is committed to creating shareholder value through share buybacks of €137.7m in 2024 and debt repayment of €85m.

For enterprises switching costs are high and with 23% of the customers being high-value enterprises, a number that increased in 2024 by 24%, we have to consider this as a factor to long-term commitment from their clients and the ability in pricing power, providing Teamviewer with a strong competitive MOAT.

Source: Teamviewer Q4/24Y presentation

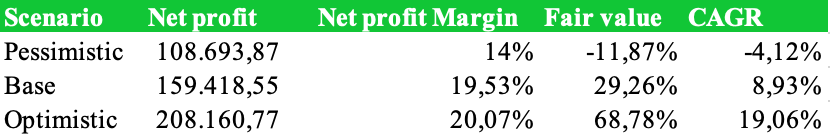

The price/earnings ratio for $TMV.DE is 15x. We’ve created three different scenarios giving the company a multiple of 15x (the average of the market), in the positive scenario we used the estimation that the company expects a 70% growth in their net profit from now to the year 2028, as they said in their results Q4/2024. This would mean a net profit margin of 20%.

In the low range, in the pessimistic scenario, we estimate the worst-case scenario where the company doesn’t achieve its goals and is also harmed by competition and macroeconomic factors. In this one, we could obtain a loss of -11% given a net profit margin a bit high compared with their worst two years in 2021, and 2022 respectively 10% and 11%.

But the most likely scenario taking into consideration its type of business: is subscription-based. Where they have long-term contracts with blue chip companies, and because of this we believe their estimations are trustworthy and achievable. The issue here is if we trust in the capability of the company to implement and execute correctly the plan, reduce costs, and create shareholder value, in this case, we will achieve a return of +68%.

Risks

- Macroeconomic events: In 2021 after the pandemic, the retention in subscriptions fell from 100% to 88%, affecting the revenue of the business and this made the price of the share fall 75% in just one year. I consider that, because of these risks, TMV.DE focuses more on enterprise growth than commercial growth.

- Technological competition: In the IT services industry, there are constant innovations that could make our companies lose their competitive advantage. The concern with TMVW is that the acquisition of 1E was because of stagnation in their capability to produce innovation by themselves, their product is no longer relevant, or they can’t maintain the revenue growth, or it was a strategy to create an ecosystem in IT services sector to enhance the customer experience.

- Valuation of 1E acquisition: The valuation for the acquisition was $ 720M, with a $77M Annual recurring revenue, which means a little more than 9x Sales. A number that seems aggressive in my opinion, but here the question is, was the management seeing hidden synergies that justify the price?

- Solvency risks: with a debt/equity ratio of 6.5 they are above the maximum accepted, this is caused by the new acquisitions and they’re committed to reducing the debt in the coming years.

- Market expansion risks: the new target in the North America and Oceania expansion could present challenges, with cheaper competitors (such as Connectwise, and Anydesk with their expansion plan) and high marketing and sales expenditure.

- Failure in the execution of the plan: With any plan, companies have the risk of the goals not being achieved, this is why we have to be very conservative when analyzing their estimations.

Conclusion

Technology is the future, advances in the way we work and communicate, always looking the improvements in our quality of work, efficiency in travel time, with digital access to control any device worldwide, with the use of AI during our meetings to create live reports, and the use of AR to improve logistic procedures.

TeamViewer is often overlooked due to its size and increasing competition, but its solid revenue growth, share buybacks, and enterprise focus suggest it’s far from being an obsolete company. The acquisition of 1E adds new capabilities and offers of services but also raises valuation concerns. The key question remains: Is TeamViewer’s vision of an end-to-end IT/OT ecosystem enough to maintain growth? I do believe so, that’s why TMV is a significant part of my portfolio.

What do you think about TeamViewer’s future with this info I gave today? Let’s discuss this in my profile!

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.