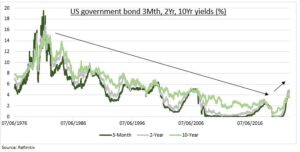

VIEW: Inflation expectations have been rising. And the size and duration of the Fed interest rate cycle is increasing. This has sent short and long term US bond yields surging. With generally negative consequences for investors. 5% short term yields are a boon to savers, but a rising hurdle to owning more risk assets. A 4% ten-year bond yield puts a ceiling over expensive stock valuations. Better news is that the worst of this bond re-pricing may be nearing an end. This would help nervous stocks. Short term yields now reflect a newly hawkish 50bps hike outlook. Above average long term real yields and flatlining copper/gold ratio give some comfort on 10-yr.

SHORT: US short term government bill yields have hit 5%. Up from zero only 18 months ago in their sharpest rise in four decades. This near risk-free return is big competition for the $18 trillion of US bank deposits earning an average 0.2%. But also a three-pronged challenge for US risk assets. 1) It’s a high risk-adjusted return hurdle for anyone considering risk assets from equities to bonds. 2) Ends ‘carry trade’, of funding higher return investments from borrowed US funds. 3) Driven up hedging costs, tied to short term US interest rates, for global investors looking at US.

LONG: 10-year US bond yields are back near 4%, re-approaching the 4.2% high from October. This puts a ceiling over many stock valuations. With the biggest impact on the most expensive markets (US) and segments (tech). Valuations are the present value of future cash flows, and the 10-yr yield the discount rate used. But we may have seen the worst. The copper/gold ratio is flatlining, not rising. Real, inflation-adjusted, 10-yr yields are at 1.5%, above 20-year average. And the 10-2 year yield curve inversion – a key recession indicator – the greatest in a generation.

All data, figures & charts are valid as of 08/03/2023