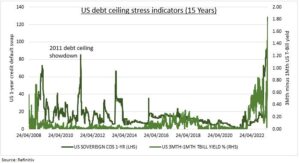

COMPLACENCY: The US debt ceiling deadline, the ‘X-date’, may be closer than thought. The government’s Fed checking account is drying up, making more dependent on tax inflows to pay the bills. These inflows are weaker than hoped after the recent annual filing deadline. This could accelerate the X-date to as early as June vs an assumed August, and pile more pressure on markets. This is being priced into short term bonds and CDS (see chart), but stocks seem complacent. VIX volatility is below average, the liquidity boost from the falling Treasury General Account fading, whilst S&P 500 index fell 15% in the 2011 showdown. Volatility would help safer haven long bond yields, the dollar, and gold. Within equities we favour big-tech and defensives.

IMPACT: We have started to see clear signs of market worry. This is already more than the 2011 showdown, itself the most nerve-wracking in modern times. The cost of insuring against a US default has risen sharply. CDS prices are over 50% higher than in the 2011 showdown. Whilst the yield premium demanded by holders of 3-month government bills, who straddle the potential default timeline, is a record 1.5% more than for 1-month bills. Congress could increase, extend, or suspend the debt limit. House Republicans may pass their own debt ceiling bill this week, but much of its contents will be rejected by Democrats. With Congress sharply divided and the 2024 presidential election on the horizon, the scene is increasingly set for sharp X-date brinkmanship.

HISTORY: This comes after the US hit its US$31.4 trillion debt ceiling in January. Markets fear a replay of 2011 which was the closest the US has come to a default since. Then the S&P 500 index fell sharply, Standard & Poors downgraded the US’s AAA credit rating, and long-term bonds rallied 10%. A repeat of this market turmoil, and ultimately slower government spending, will further tighten financial conditions already suffering 5% Fed rates and slower bank lending.

All data, figures & charts are valid as of 25/04/2023