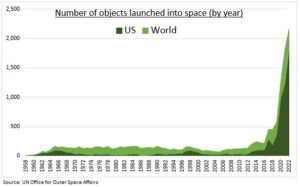

SPACE: The space market is soaring but space stocks are not. The number of objects launched has quadrupled in just the last four years (see chart), and SpaceX’s $140 billion private-market valuation is now bigger than either Boeing (BA) or Lockheed Martin (LMT). But investing in the young, inherently risky, and capital-intensive space industry is difficult. All space-related ETFs have under-performed the S&P 500 the past five years, and Virgin Galactic (SPCE) subsidiary Virgin Orbit went bankrupt. But the investable universe is expanding, from rockets to satellites, imagery and data, and its innovations typically find their way into many earth-bound products.

BOOM: The space market is booming with nearly 2,163 objects launched last year, up from 453 four years prior. This rapid growth is driven by tech advances from rocket reusability to satellite miniaturization, and the lower costs are a flywheel driving adoption further and faster. The harsh space environment has long made it a tech first-mover, impacting everything from terrestrial camera phones, CAT scans, solar cells, and sneakers to memory foam. The space market is dominated by the US and SpaceX, with 62 launches this year and the biggest fleet of satellites. But India’s recent $70 million Chandrayaan-3 moon landing a timely reminder it’s no monopoly.

BUST: There is a broadening range of space-related stocks including military contractors like Lockheed Martin (LMT), rocketry like Rocket Lab (RKLB), engines like HEICO (HEI), batteries like SES (SES), engineering like Oceaneering (OII), satellites like Viasat (VSAT), navigation like Trimble (TRMB), and space tourism like Virgin Galactic (SPCE). But the available ETFs have all under-performed the S&P 500 in the past five years, with the industry young, capital intensive, and inherently risky. These funds range from ARK’s Space Exploration and Innovation (ARKX) through tickers ‘UFO’ and ‘ROKT’ to the broader and bigger Aerospace & Defence (ITA) ETF.

All data, figures & charts are valid as of 06/09/2023