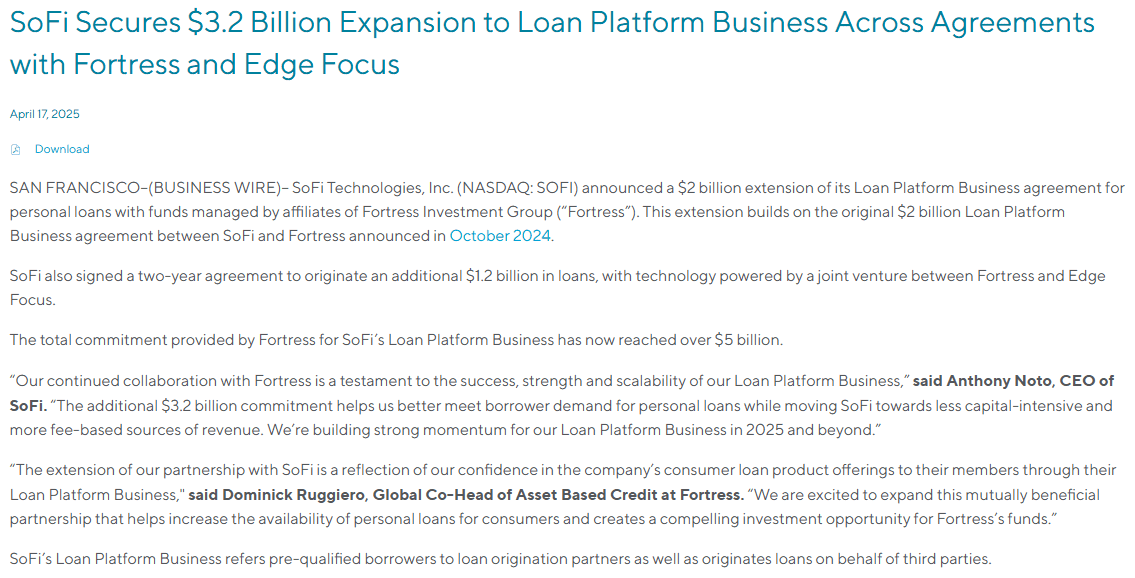

In another groundbreaking announcement for SoFi, the financial services company has confirmed a strategic deal with Fortress Group valued at $3.2 billion. This plan comprises a $2 billion extension for a one-year term and an additional agreement to originate $1.2 billion in loans over two years with Edge Focus, marking a significant 150% increase from previous agreements. What’s even more exciting is that this deal comes before the prior deal of $2 billion has completed. This is also on top of the existing Blue Owl deal, which was for $5 billion across two years. The collaboration with Fortress emphasizes the quality of loans being processed, as it illustrates their confidence in SoFi’s underwriting capabilities, showcasing growth in the financial technology sector, despite this announcement coming in a challenging macroeconomic environment that has influenced the stock market negatively.

The implications of this agreement are multi-faceted, ranging from an anticipated boost in loan origination, improved underwriting capabilities due to expanded data analysis, and cross-selling opportunities within other SoFi products. As the company aims to shift more lending towards their loan platform model, financial growth prospects appear very positive, promising higher return on equity and the potential for a significant uptick in revenue.

Source: SoFi Investor Relations Page

Highlights

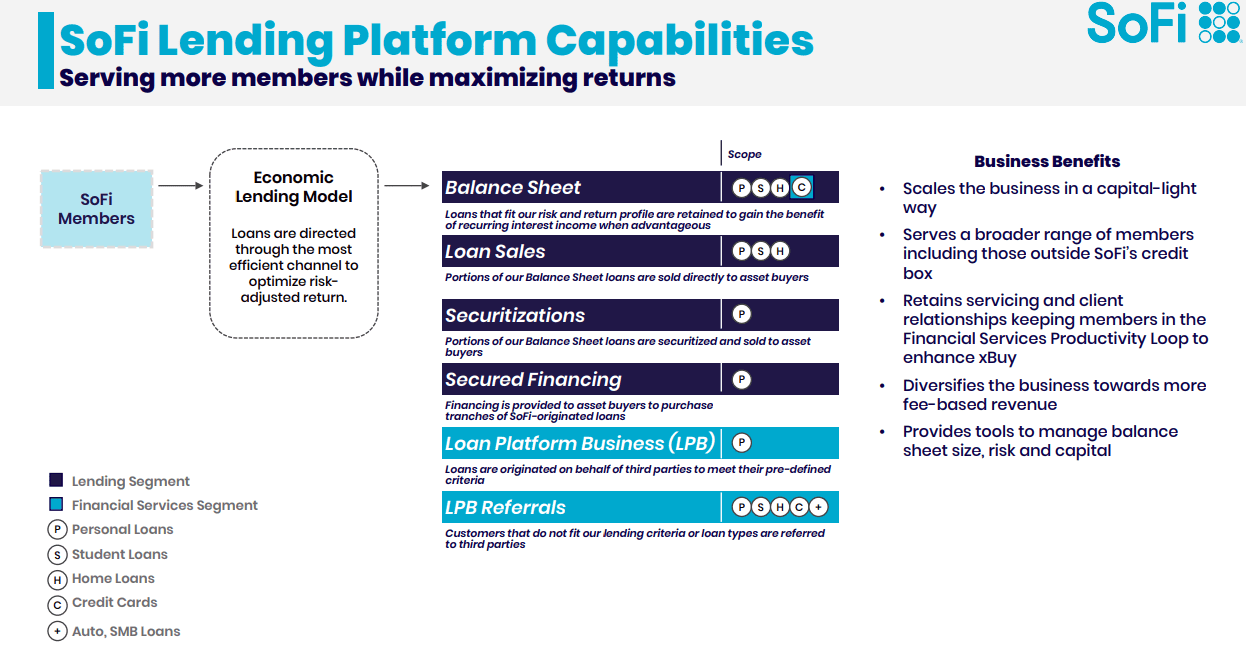

🔹 Attractive Economic Model: The shift towards a loan platform model supports a lighter balance sheet, ultimately enhancing return on equity. SoFi’s strategy to originate loans on behalf of third parties minimizes its own risk exposure and by acting as a facilitator, SoFi shifts the risk of loan defaults away from its balance sheet, enhancing its financial resilience even in turbulent economic climates.

🔹 Quality Over Quantity: The continuation of loans from Fortress Group indicates a critical understanding of SoFi’s approach to underwriting. By finding a renewed partnership so soon, it highlights that Fortress sees value in the asset quality of loans being processed. This suggests that SoFi’s rigorous risk assessment allows them to tap into high-quality loan origination, thus enhancing their reputation within the industry.

🔹 Data-Driven Enhancements: With higher volumes of loans being processed, SoFi will gather more data to refine its risk models. This continuous assessment will enhance their ability to accurately evaluate creditworthiness, thus solidifying their underwriting standards. The learning from enhanced data analytics leads to smarter business decisions, tabling SoFi as a data-driven organization.

🔹 Cross-Selling of Services: SoFi’s structure facilitates the cross-selling of other financial products, such as credit cards and banking services, to customers applying for loans. This creates a more integrated consumer experience, allowing the company to capitalize on consumer wallet share by encouraging usage of multiple products, drastically improving average revenue per user.

🔹 Projected Financial Growth: The deal with Fortress Group significantly boosts SoFi’s loan origination and revenue potential. With projections indicating that personal loan sales could reach upwards of $4 billion, these figures support the argument for a valuation shift toward SoFi. Increased origination results in increased liquidity, solidifying SoFi’s standing as a competitive player in the financial technology space.

🔹 Long-Term Revenue Building: SoFi’s strategy, aiming to shift its lending structure to a loan platform model, is significant. This model supports consistent quarterly revenue streams by focusing on loan agreements over time, rather than one-off projects, which inherently creates a more stable financial future and reduces revenue volatility. This shift holds long-term potential, as profitability metrics could improve substantially over years of accumulated learning and business refinement.

🔹 Competitive Edge: SoFi’s focus on their loan platform over other segments like brokerage services positions them more competitively within the industry. By leveraging their bank charter’s advantages, they can efficiently tap into demand and pursue growth avenues that other competitors may not be able to exploit effectively, and unlike competitors that may solely focus on loan products, SoFi is innovatively positioned to not only provide financial products but also tap into a blend of affordable financing solutions and financial planning services. This holistic approach enhances customer retention, presenting SoFi as an all-encompassing financial partner in the consumers’ lives, giving it a unique edge over more traditional financial institutions.

🔹 Market Demand: Despite macroeconomic uncertainties, there remains a strong demand for personal loans, validating SoFi’s operational stability and growth. The velocity of these deals shows demand is high and implies the expectation of sustained enterprise performance.

🔹 Investor Attraction: Given the positive reception and evaluation of SoFi’s loan quality, it is likely that analysts will revise their projections for the company favourably. Coupling a robust deal pipeline with investor confidence in earnings quality could increase market sentiment and lead to a more favourable valuation of SoFi’s stock.

Loan Platform Growth

SoFi has historically expanded cautiously in the loan sector but in just 12-15 months, SoFi has engaged in approximately $12 billion worth of deals through its loan platform. The projected growth in loan origination volume implies that SoFi may soon experience a significant surge in revenue. Assuming their estimate of a 4% take rate holds, projected revenues could reach around $470 million from the recent $12 billion in total loan originations, translating to an ongoing income stream that supports business expansion. If SoFi can scale this effectively, they could significantly drive their balance sheet growth, whilst lowering risk.

Source: Latest SoFi earnings deck

Valuation

SoFi’s guidance for 2025 likely doesn’t fully account for the additional revenue expected from these recent deals or even for the anticipated reintroduction of cryptocurrency, representing a significant surprise factor for potential investors and analysts alike. This underestimation of potential earnings power creates a strategic buying opportunity at the current market price.

Despite significant business advances, SoFi’s stock does not seem to reflect the strong fundamentals. Market prices reflect substantial discrepancies related to the company’s growth strategies against macroeconomic factors such as tariffs and speculation about recessions. These discrepancies could present an invaluable opportunity for savvy investors, as enhanced growth avenues might take time to be recognized by the market.

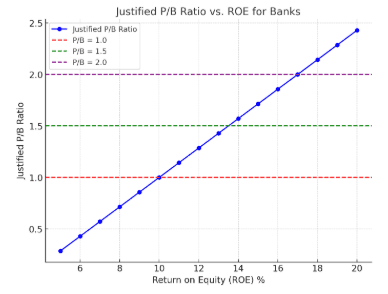

Currently, if we price SoFi as a bank using P/B, SoFi appears to be a little on the expensive side at 1.8x. However, ROE could see some considerable moves to the upside with these new deals.

More importantly, this means we aren’t giving SoFi a hybrid multiple, which is still a hot topic with investors.

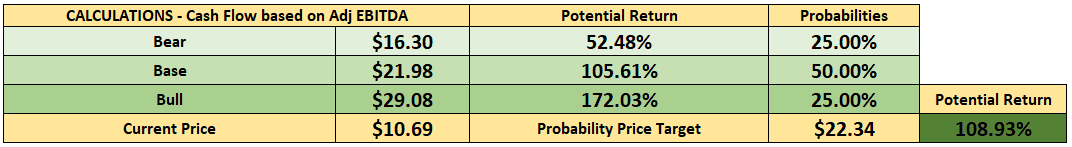

We can tweak a DCF calculation using adjusted EBITDA, less Capex, and adding back the book value in lieu of cash flow, which would be more appropriate for this type of hybrid company. We’re also using a variable growth rate, starting from the 25% SoFi is guiding with and dropping down to a terminal rate of 4% over a 10-year period.

Risks:

SoFi (Social Finance Inc.) operates a diversified fintech business, and while it’s been growing rapidly, several risks could materially impact its performance. Here’s a breakdown of key business, financial, regulatory, competitive, and macroeconomic risks:

🔹 Regulatory and Compliance Risk – Exposure to changing financial regulations and banking oversight due to its bank charter and fintech operations, although one could argue this is less impactful since financial regulation is set to ease. This is reflected partially in the relaxation of crypto trading for SoFi.

🔹 Credit Risk – Potential for rising loan defaults, especially in personal and student loan portfolios, during economic downturns. SoFi does target higher credit scores, so something to bear in mind regarding this point.

🔹 Interest Rate Risk – Sensitivity to rate changes, which can affect loan demand, deposit costs, and net interest margins.

🔹 Competitive Risk – Pressure from both traditional banks and fintech rivals offering similar or better financial products.

🔹 Execution Risk – Challenges in scaling new business lines or integrating acquisitions like Galileo and Technisys effectively. Unlike the loan platform business, those products have had growth problems.

In conclusion:

The developments surrounding SoFi’s recent partnership with Fortress Group indicate a paradigm shift towards a more robust, data-informed, and customer-centric financial service model. As they solidify their market presence through loan origination and improved underwriting accuracy, SoFi is creating a competitive hierarchy that positions them favourably for long-term growth and success.

It’s a capital-light, high-margin growth engine that’s scaling faster than anyone expected and it’s only just getting started. With cross-sell potential, improved underwriting intelligence, and the ability to attract new institutional capital, SoFi is not just optimizing its current business, it’s redefining the future of consumer lending. This is yet another example of how SoFi can pivot into new business segments with ease, indicating a change that is too significant to be overlooked in today’s financial landscape. Ultimately, this partnership serves as a stepping stone to even greater achievements for SoFi in the coming years.

Given the strong demand for personal loans, the future looks bright for SoFi’s growth trajectory, even in uncertain economic conditions. Could SoFi move all their lending into the loan platform business over time? The balance sheet would be lighter and who would complain about a higher return on equity?

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.