Siemens Energy ($ENR.DE) took on a lot of attention as it has raced up ~300% over the past twelve months. Through evaluating Siemens Energy’s financials and their near (~5 year) future I hope to provide you with the necessary information to figure out if investing now remains attractive.

Business Profile

Siemens Energy operates across the entire energy technology and service value chain related to power generation, both for conventional and renewable energy.

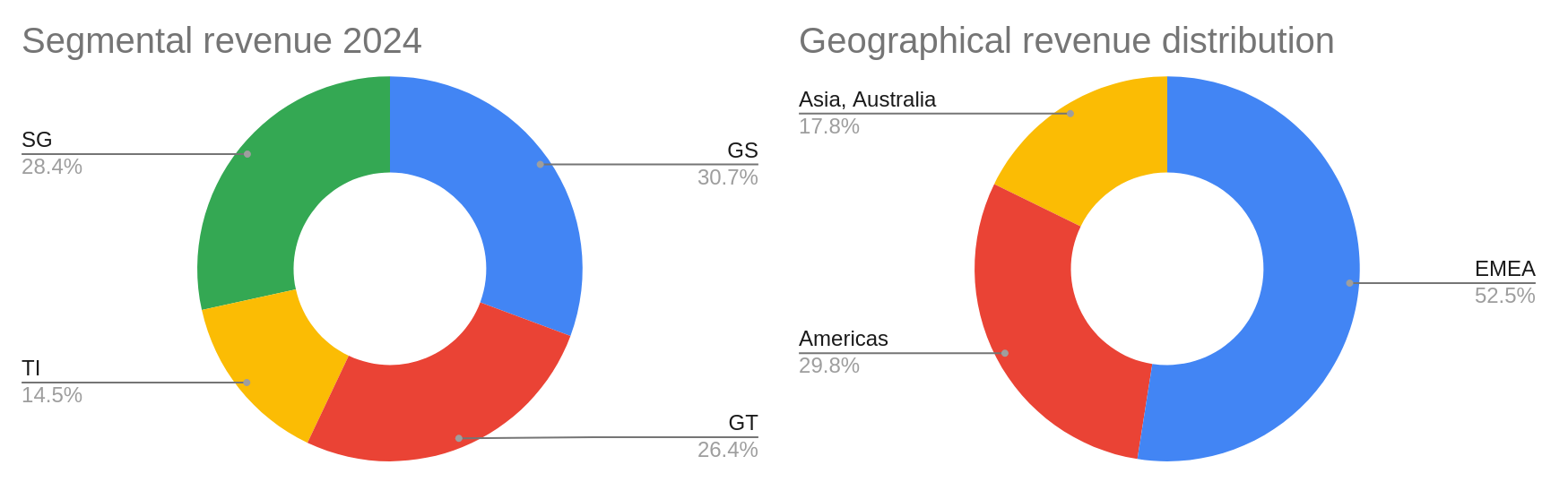

The business operates as follows:

- Gas Services (GS): Gas and large steam turbines, large generators and heat pumps.

- Grid Technologies (GT): transmission systems, substations, switchgear, transformers and storage solutions.

- Transformation of Industry (TI): TI is a collection encompassing eElectrolyzers, stream turbines, generators, compressors and services. It consist of various operating segments:

- Sustainable Energy Systems (SES)

- Electrification, Automation

- Digitalization (EAD)

- Industrial Steam Turbines & Generators (STG)

- Compression (CP)

- Siemens Gamesa (SG): onshore and offshore wind turbine components to installation and post installation services and maintenance.

Siemens Energy is quite diversified, even for a conglomerate, across both business units (traditional energy and newer technologies) and geographically.

Investment case

The company benefits from large long term trends such as the upgrading of our aging electrical infrastructure and renewable energy production and storage. Over that last couple of years the former has proven to be a good baseline driver for the company. The latter however, led by SG, has run into quite some trouble with which I will start the investment case as I find it important to not overlook such things. SG has been a wholly owned subsidiary since July 2023 before which it already owned a large stake. In June 2023 problems surfaced related to the quality of the 4.x and 5.x onshore wind turbines. The costs of this have been north of €2 billion so far. There is light at the end of this tunnel however as sales have resumed after a year of tackling the aforementioned issues.

Now to a more positive note on Siemens Energy as a whole, the main case for investors is long term margin improvements combined with medium to high single digit top line growth with all segments having a favourable future outlook. Raising estimates has given investors confidence that Siemens Energy can get over the SG debacle and provide an attractive growth path going forward.

Some of the key drivers besides large structural trends for this are supposed to be the ongoing restructuring at SG, including market refocus and project risk reduction, which aims to improve profitability and stability. Furthermore, the divestment of non-core assets provides opportunities for capital reallocation and improved strategic focus. For example Siemens AG acquired an 18% stake in Siemens Limited India from Siemens Energy for €2.1 billion which frees up significant capital, this is expected to be completed somewhere in 2025.

If Siemens Energy ($ENR.DE) is able to execute on these margin improvements I believe they have the opportunity to follow a similar path to another industrial spinoff, GE Vernova which has been able to substantially improve margins. As a large portion of near term revenue is already secured it becomes mostly a margin game for management which they have been able to deliver on so far besides SG.

Risks

The elephant in the room is the issue related to the quality of the 4.X and 5.X platforms from SG. Sales were suspended for an extended period of time and large losses were incurred in the last 2 years. If the issues are not of a one off nature this could lead to a significant writedown again. Furthermore project execution does not go without risk, cost overruns, delays and technical challenges are not uncommon and remain a risk for any company in the sector. Siemens Energy also receives large orders, the timing of these can recognize the revenue throughout a project can make for unpredictability in the short term leading to greater earnings volatility. Furthermore the company is a large conglomerate which makes analysis difficult, I might have missed items (especially as Siemens Energy likes to work with adjusted numbers).

Valuation

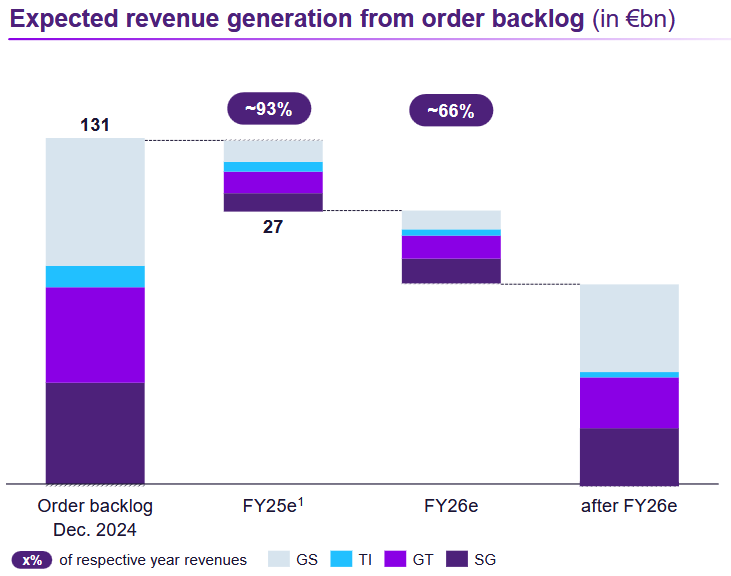

Valuing a large conglomerate is not easy, just taking in overall revenue and extrapolating is nothing more than a gamble. I took a segmental forecasting approach after which I did a simple annual rate of return calculation (which I explained in an earlier article of mine about UMG) on the sum of parts, in this case the final calculation is done using free cash flow to equity (FCFE) as Siemens Energy has a lot of incidental items. I start with order execution, order intake and backlog after which I apply the guidance provided by management on the margins (profit before special items) which I then adjust for special items and D&A to arrive at segmental EBITDA numbers (naturally this is same reconciliation as Siemens Energy uses), the summations can be seen in Table 1 below (notice the 2026 jump as GT opens two factories). In this blog article I will not go into much further detail as that greatly increases the length of this short form blog post, if you have any questions feel free to reach out!

Figure 1: backlog at fiscal Q1 2025, Siemens Energy

| Group level | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 |

| Revenue | 31118 | 34466 | 37496 | 40419 | 44947 | 47822 | 50853 |

| EBITDA | -1776 | 2069 | 2697 | 4290 | 5477 | 6359 | 7289 |

| EBIT | -3292 | 558 | 1097 | 2640 | 3827 | 4659 | 5539 |

| Taxes | -1202 | -487 | -329 | -845 | -1225 | -1491 | -1773 |

| Interest | -130 | -303 | -100 | -200 | -200 | -200 | -200 |

| Capex | -1228 | -1514 | -1000 | -1000 | -1000 | -1000 | -1000 |

| NWC | 3388 | 3216 | 1500 | 1200 | 1000 | 700 | 200 |

| FCFE | -2464 | 1470 | 1168 | 1795 | 2402 | 2668 | 2767 |

Table 1: Group level earnings and forecast summary, based on Siemens Energy forecasts and author’s own forecasts

Given a market cap of ~€42.5B, a current forward FCFE yield of 2.4% and an expected FCFE yield of 4.75% (so multiple contraction) in 2029 I arrive at a 10.19% expected annual return for the next 5 years. All numbers here are based on the share price at the time of writing which was €53.6. This provides ample margin of safety and in my opinion checks of the valuation box given that management has a relatively decent track record on actually executing on the outlook given in previous years.

Conclusion

Has Siemens Energy ($ENR.DE) run up a lot, yes but the underlying investment case arguably improved significantly over the past year. This is supported by long term trends and optimizations within Siemens Energy itself over the coming years. While revenue visibility offers stability, execution risks remain. The potential upside makes Siemens Energy attractive for long-term, risk-tolerant investors who want a potential European industrial titan in their portfolio with exposure to our worldwide energy infrastructure needs.

The author of this analysis does not hold shares in Siemens Energy at the time of writing, which may influence the perspective provided. Please conduct your own research or consult with a financial advisor before making any investment decisions.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.