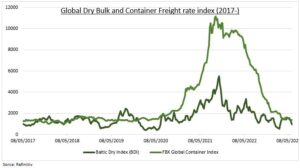

RATES: The shipping industry moves 90% of global trade, making it a real-time barometer. Both dry bulk and container shipping rates have plunged from their pandemic highs (see chart) as supply-chains and goods demand normalize. Prices remain pressured as China’s reopening disappointed bulk commodity markets, and US and European import demand is running below pre-pandemic levels. This has been a relief to global inflation worries. But joins weak commodity prices, manufacturing PMIs, and China trade data in warning on the world’s growth risks. Major carriers from container-giants Maersk (MAERSKB.CO) and Hapag Lloyd (HLAG.DE) to bulk leaders ZIM (ZIM) and Star (SBLK) are seeing a double hit of lower prices and weaker volumes.

CONTAINER: The Freightos Baltic Index (FDX) tracks 40 ft container rates, used for consumer goods from electronics to clothing and furniture. It’s a weighted average of 12 regional shipping routes across the Pacific, the Atlantic, and through the Suez Canal. Container volumes remain under pressure from retailer inventory destocking. There is hope for a second-half demand stabilization, but some risk that new container ship capacity boosts supply and weakens prices.

BULK: The Baltic Dry Index (BDI) tracks bulk commodity shipping rates. It’s a composite of three vessel sizes, across 20 routes, carrying coal, iron ore, and grains. Capesize (40% index weight) are the largest, used for iron ore and coal, and too big to transit the Panama or Suez canals. Panamax (30%) are smaller, so-named as the largest size to transit the Panama canal, and focused on coal and grains. Supramax (30%) are smaller, focused on cement and iron ore. Both volumes and prices have been under pressure, with grains the relative volume bright spot. The industry has responded with slower steaming speeds and increased capacity scrappage.

All data, figures & charts are valid as of 07/06/2023