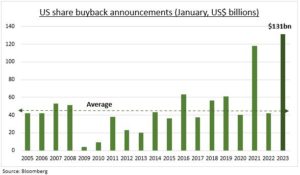

SURPRISE: US share buyback announcements have tripled versus January last year. This is a welcome surprise and a key support to US equity markets. Stock buybacks have historically been by far the biggest buyer of US equities. They are also unique to the US, with the rest of the world preferring dividends. Most notably, Chevron (CVX) announced a $75 billion buyback plan, equivalent to 20% of its market cap. Meta (META) followed with $40 billion, equal to 10% of its then market cap. These come despite the Dec. 31st start of the new 1% buyback tax. And with profits seeing their first falls since 2020, pressured by sticky inflation and the slowing economy.

NUMBERS: US companies likely bought back close to $1 trillion of their own shares last year, boosting EPS and supporting the stock market. This would be a new record. Near 90% the S&P 500 constituents bought back shares last year. This also came alongside a 10% pick up in total dividend payments to $560 billion. A lesser 80% of the S&P 500 pay a dividend. This combined buyback plus dividend yield was close to 5%. US companies are unique globally in preferring buybacks 2:1 vs dividends. This is driven by 1) tax advantages, 2) higher levels of employee share plans, 3) more widely dispersed shareholder bases, and 4) greater flexibility vs dividends.

OUTLOOK: We are a little skeptical this pace of share buyback activity can continue throughout the year. We note that buyback plans are not actual buybacks. They also remain concentrated, with the top-20 stocks accounting for half of buybacks. It’s an unsung support to big-tech, who are by far the largest buyback users. Though with energy stocks use rising rapidly. We think this speaks to the relative US profit resilience ahead and strong cash flow discipline. Buybacks are a big and unique support to US equities as battle headwinds of high valuations and lower profits.

All data, figures & charts are valid as of 06/02/2023