Summary

Private equity to Collectibles ‘alternatives’

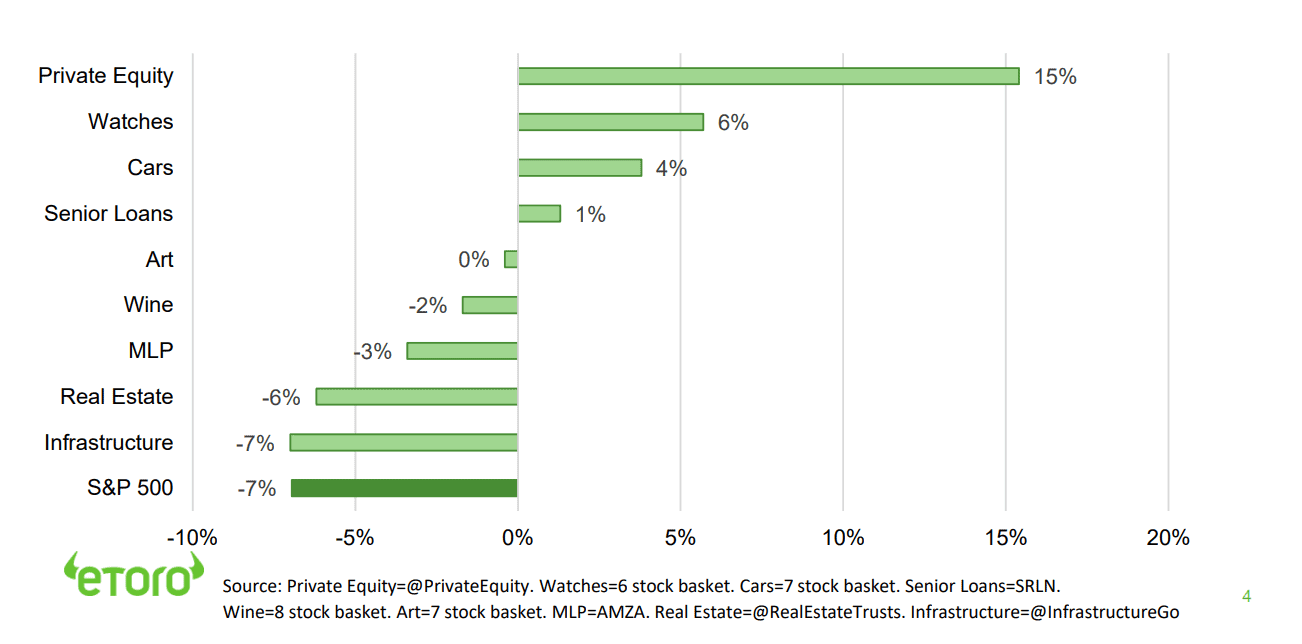

So-called ‘alternative’ assets from private equity, infrastructure, pipelines, and real estate through to collectible wine, watches, cars, and art all have different drivers to traditional stocks and bonds. They can thus offer attractive and uncorrelated long term returns and also boost diversification. Access to this smaller asset class is becoming easier through public markets. This starts to offset the traditional ‘alternatives’ problems of illiquidity, minimum size, and cost.

Markets digest earnings and stronger dollar

Stocks flatlined as we near May, with VIX volatility falling <17. A less-bad start to Q1 earnings and strong China GDP growth and PMIs was balanced by higher US bond yields and dollar. Whilst UK digested inflation still over 10%. TSLA price cuts hits its high profit margins. TSMC warned on chip demand. And pharma giant MRK bought RXDX for $12 billion. See 2023 Year Ahead HERE. Video updates, twitter @laidler_ben.

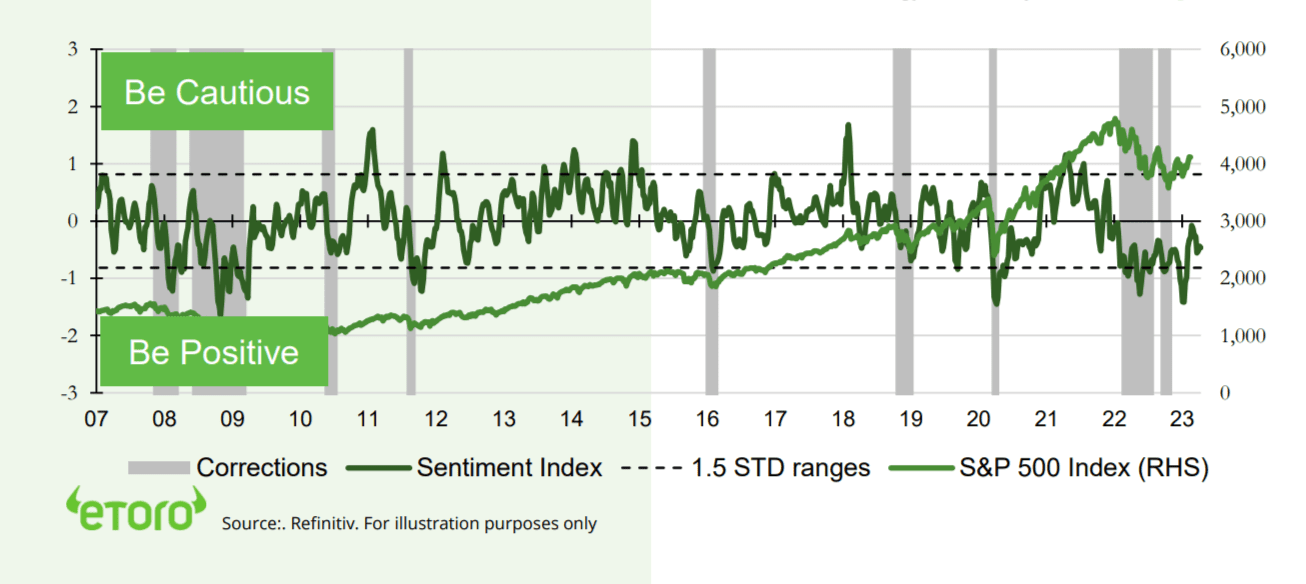

Poor sentiment still supports markets

Our proprietary sentiment index of fund flows, retail views, put/call ratio, VIX below average and a contrarian support to markets. The ‘broken’ VIX may even understate the pessimism.

The best and worst of global FX

European currencies best and worst performers YTD. Eastern Europe’s HUF, CZK, and PLN led up on high carry. But opportunity may now be weak ILS and TRY as event catalysts loom.

Gold having its moment in the sun

Gold having a moment in the sun, rallying above $2,000 on lower bond yields, weaker dollar, and safe-haven demand. Opportunity may be a gold equity catch up. @GoldWorldWide.

Earth Day focus on renewables resilience

53rd annual Earth Day a reminder of resilience of cleantech investment themes. Top of mind in our latest survey. @RenewableEnergy.

Crypto rally sees a setback

Crypto prices fell back after a huge rally this year, on market volatility and the stronger US dollar headwinds. TRON and LINK were most resilient. Regulations were in focus with the EU MiCA law parliament passage, SEC’s Gensler regulation crackdown defence to Congress, and Coinbase (COIN) offshore Bermuda license.

Commodities fall on dollar and lower oil

Commodities fell back as a stronger dollar offset stronger China Q1 GDP. Oil prices led slump on recession demand fears. Best performing sugar rally hit an 11-year price high on India’s supply disruption. Lithium slide continued even as TSLA cut prices to stoke volume, and major producer Chile moved to nationalise industry.

The week ahead: Q1 earnings, GDP, May

1) GOOG, MSFT, AMZN, META big tech Q1 plus KO, MCD, XOM. 170 report. 2) Q1 GDP slowdown in US (est. 2.6% growth) and EU (est. 0.2%). 3) First BoJ meeting w/ new governor and US ‘Fed favourite’ PCE inflation (est. 4.5%). 4) Last day of April (Fri) and weak seasonality start.

Our key views: Accelerated macro outlook

Banking fears individual not systemic. But doing Fed’s job for it. Accelerating GDP and inflation slowdown and interest rate peak. See market recovery with bumps in road. Slowdown hurts earnings. Low yields help valuation. Focus cheap and defensive assets, from healthcare to big tech More cautious on cyclicals and banks.

Top Index Performance

| 1 Week | 1 Month | YTD | |

| DJ30 | -0.23% | 4.87% | 2.00% |

| SPX500 | -0.10% | 4.09% | 7.66% |

| NASDAQ | -0.42% | 2.10% | 15.34% |

| UK100 | 0.54% | 6.87% | 6.21% |

| GER30 | 0.47% | 6.18% | 14.06% |

| JPN225 | 0.25% | 4.31% | 9.47% |

| HKG50 | -1.78% | 0.80% | 1.49% |

*Data accurate as of 24/04/2023

Market Views

Markets digest Q1 earnings and stronger dollar

- Stocks treaded water as near month end, with a less-bad start to Q1 earnings and strong China GDP growth balanced by higher US bond yields and dollar. VIX volatility fell below 17. Whilst UK digested inflation still over 10%. TSLA price cuts hits its high profit margins. TSMC warned on chip demand. And pharma giant MRK bought RXDX for $12 billion. See our 2023 Year Ahead HERE.

Poor sentiment still supports markets

- The reversal rally this year by the 2022 losers has been painful for most investors who have stayed cautious. Our sentiment index – of fund flows, retail sentiment, put/call ratio, and the VIX – is still below average and a contrarian support. It leaves many able to boost stock holdings as the fundamentals continue to be ‘less bad’. It even understates the level of actual pessimism given the big falls in the ‘broken’ VIX volatility index.

- We see an accelerated economic and inflation slowdown leading to early rate cuts. Forward looking, and long-duration focused, markets will likely benefit from this faster move.

The best and worst of global FX

- European currencies been both some of world’s strongest, and weakest this year. Eastern Europe led way, with the Hungarian Forint (HUF) surging 10% vs the dollar, with Czech Koruna (CZK), Polish Zloty (PLN), and Romanian Leu (RON) not far behind. Region has piggy-backed off the strong EUR and from its own high interest rate differential ‘carry’ after an early rate hike start.

- Also benefits from high-beta leverage to EU’ growth surprise, as natgas prices fell and China reopened. But gains will be tougher from here, with valuations fuller. Others like Israel Shekel (ILS) and Turkey’s Lira (TRY) hit by uncertainty but lower valuations and clearer possible upside catalysts.

Gold having its moment in the sun

- Gold having a moment in the sun. Up strongly this year and near $2,070 all-time multi-millennial high, after disappointing 2022. Rally driven by perfect trifecta of 1) lower US interest rate expectations, boosting long duration and non-yielding assets like gold (and ‘digital gold’ bitcoin). 2) A weaker dollar, making cheaper for big buyers in India and China.

- 3) And as saw some demand for ‘safer-haven’ and uncorrelated assets, with US bank ‘scare’ and high recession risks. We are positive long duration assets, like gold, but greater opportunity may be in a gold equity catch up and potential for industry consolidation. @GoldWorldWide.

Earth Day focus on renewables resilience

- Earth Day marks the anniversary of birth of modern environmental movement in 1970. The theme for the 53rd Day is ‘invest in our planet’. Cleantech is number one thematic investment priority in every country and demographic in our global survey.

- This has driven resilient fund inflows that bucked the strong outflows seen by broader funds. This comes even as renewables stocks lagged and as broader ESG has seen a backlash. See @RenewableEnergy, @BatteryTech.

eToro composite investor sentiment index vs S&P 500

Crypto rally sees a setback

- Crypto assets fell back, taking a breather after their big 65% rally this year and with headwinds from a stronger US dollar and rising US bond yields. BTC fell back below $30,000, whilst TRON and LINK were the most resilient major coins.

- Regulation took centre stage as EU Parliament passed its MiCA regulatory framework, which could be law by July. Whilst US SEC chair Gensler defended regulatory crackdown before Senate.

- Société Générale (GLE.PA) launched an ETH backed stablecoin for its clients. Coinbase (COIN) gained an offshore Bermuda regulatory license.

Commodities hurt by dollar strength

- Commodity prices fell back under weight of higher US bond yields and a stronger dollar. This more than offset the 4.5% Q1 China GDP growth surprise. The energy complex led down with Brent, gasoline, and heating oil, all sharply lower.

- Sugar continued its blistering rally this year, and is the best performing major commodity. At $0.25/lb its near an 11 year price high driven by supply disruption in major producer India.

- Lithium prices slumped further and now -60% this year after China slashed EV subsidies and new lithium production hit the market. Comes despite TSLA continuing to slash EV prices to boost growth. Whilst leading global producer Chile shocked by moving to nationalise lithium.

US Equity Sectors, Themes, Crypto assets

| 1 Week | 1 Month | YTD | |

| IT | -1.13% | 1.93% | 19.03% |

| Healthcare | 0.22% | 5.21% | -0.59% |

| C Cyclicals | 0.65% | 1.94% | 13.59% |

| Small Caps | 0.58% | 0.77% | 1.72% |

| Value | -0.02% | 3.47% | -0.51% |

| Bitcoin | -9.55% | -2.83% | 65.76% |

| Ethereum | -11.07% | 2.84% | 54.87% |

Source: Refinitiv, MSCI, FTSE Russell

The week ahead: Q1 earnings, Q1 GDP, Month end

- Big tech earnings in US with GOOG, MSFT, AMZN, META, plus consumers KO, PEP, MCD, V, MA, and oil giants XOM, CVX. 20% S&P 500 reported with resilient 77% beating ests. 170 report this week.

- After China’s 4.5% Q1 GDP surge it’s now time for the US and Europe. With US GDP growth forecast to slow from a Q4 2.6% pace to still resilient c.2.0%, and EU stabilise at c.0.2% after prior 0.0%.

- Interest rates remain in spotlight with Japan’s BoJ to meet for first time with new governor Ueda. It remains the global outlier with -0.1% rates. Whilst US ‘Fed favourite’ PCE inflation seen down to 4.5%.

- Friday is the last trading day of April. The month has seen global stocks modestly positive, led by overseas markets. May starts 6 months of usually poorer ‘summer doldrums’ market seasonality.

Our key views: An accelerated macro outlook

- Banking sector fears are likely individual not systemic. Bank buffers are bigger now and the authorities response stronger. But this is doing the Fed’s job for it. By accelerating the GDP and inflation slowdown and the interest rate peak.

- See a V-shaped market recovery with plenty bumps in road. Faster slowdown hurts earnings. But lower bond yields helps valuation. Focus on cheaper and more recession defensive assets, from healthcare to derated big tech. More cautious on assets most exposed to recession risk, like cyclicals, small caps, and commodities. Or lower yields, like banks.

Fixed Income, Commodities, Currencies

| 1 Week | 1 Month | YTD | |

| Commod* | -2.08% | 2.48% | -6.41% |

| Brent Oil | -5.63% | 9.57% | -4.93% |

| Gold Spot | -1.16% | 0.66% | 8.96% |

| DXY USD | 0.17% | -1.35% | -1.74% |

| EUR/USD | -0.02% | 2.14% | 2.70% |

| US 10Yr Yld | 5.71% | 20.04% | -30.29% |

| VIX Vol. | -1.76% | -22.86% | -22.61% |

Source: Refinitiv. * Broad Bloomberg index. * Basis point

Focus of Week: Investing in ‘alternative’ assets

Increasing diversification is the name of the investment game right now

The clear message from our global retail investor survey is that diversification increasingly matters to retail investors. They now hold over half their stock holdings outside of home markets for the first time. Every one of the smaller asset classes, from bonds to currencies and commodities saw their allocations increase. This makes sense with the macro environment very uncertain and risks still high. To this broader investing menu, we add so-called listed ‘alternative assets’. From private equity to infrastructure, real estate, and collectibles. They are smaller and more specialized investment areas. That often have different return drivers to traditional stocks and bonds, and benefit from lower long term interest rates. And this can aid diversification and returns (see chart). These are now increasingly available through public markets.

They provide a wide range of investing alternatives, from private equity to collectibles

Alternative investments is a catch-all term for all those smaller assets outside of the main equity, bond, commodity, FX, and crypto asset classes. This often includes real estate, from farmland and forestry to residential housing and healthcare facilities. Private equity investments across unlisted companies, and loans to private companies. And in infrastructure like roads, airports, pipelines, and railroads. This can also incorporate renewables infrastructure like wind and solar projects. It also often includes so-called ‘collectibles’ investments such as in fine wine, luxury cars, high end art, or specialty watches.

Alternatives have diversification benefits and are becoming more available in public markets

Alternative investments tend to be characterised by a lower correlation with other assets, which helps diversification. They often also have long term inflation protected or more defensive cash flows. This makes them exposed to long term bond yields and therefore ‘long duration’. But they are also typically unlisted and need long lock-up periods until they can be sold. They have large minimum investment levels, and often high fees. But these disadvantages are now starting to be offset by the possibility to gain exposure though listed vehicles which can offer similar returns if held for the long term.

They should track performance of their underlying assets in the long term

Many private equity managers are now publicly listed, and their long-term share price returns should mirror their underlying private assets. Private loan ETFs are publicly traded. Similarly, listed infrastructure, pipeline (MLP) and real estate (REITS) stocks should ultimately mirror the performance of their underlying physical assets. Collectibles is a further market where publicly listed luxury automakers, watch makers, wine makers, and art exhibitors can offer long term exposure to the health of their underlying industries.

Listed ‘alternative’ assets price outperformance vs S&P 500 (1-Year)

Key Views

| The eToro Market Strategy View | |

| Global Overview | Aggressive Fed interest rate hiking cycle, stubborn inflation, and now financial sector concerns, is accelerating our 2023 view. Of a quicker GDP slowdown, lower inflation, and a peaking Fed interest rate cycle. Will pressure earnings further but also lower bond yields and take pressure off de-rated valuations. We are invested, believing Oct 2022 was the low, and focus on cheap and defensive assets for a faster ‘V-shaped’ market recovery. See our Q2 Outlook HERE |

| Traffic lights* | Equity Market Outlook |

| United States | World’s largest equity market (60% of total) seeing slowing but resilient GDP and earnings growth. Valuations led the market rout, and now at average levels, and are supported high company profitability and near peak bond yields. Focus on cash-flows defensives, like healthcare and high dividend. Big-tech supported by defensive growth. See gradual ‘U-shaped’ rebound as inflation slowly falls and de-risks market and tech/small cap/crypto appetite. |

| Europe & UK | Favour defensive and cheap UK (‘Economies not stock-markets’) and continental European equities. Recession risk easing with lower natgas prices amd reopening China with high ‘buffers’ of rising fiscal spending (defence and refugees) and weak Euro (50%+ sales overseas). Even as ECB hikes aggressively. Equities cushioned by lack of big tech sector and 30% cheaper valuations vs US. Banks better capitalised and regulated but loans/GDP much higher. |

| Emerging Markets (EM) | China, Korea, Taiwan dominate EM (60% wt.), and more tech-centric than US. Positive on China as economy reopens, cuts interest rates, and eases tech regulation crackdown. Valuations 40% cheaper than US and market out of favour. Recovery helps global sectors from luxury to materials. Broader EM needs weaker USD and peak US rates catalyst. |

| Other International (JP, AUS, CN) | Canada and Australia benefit from strong equity market weight in commodities and financials, if global growth resilient and bond yields risen. Japanese equities among worlds cheapest but threatened by tightening monetary policy and stronger Yen with rising inflation and new BoJ governor. |

| Traffic lights* | Equity Sector & Themes Outlook |

| Tech | ‘Tech’ sectors of IT, communications, consumer discretionary (Amazon, Tesla), dominate US and China. Hurt by higher bond yields and above average valuations. But structural stories with good growth, high margins, fortress balance sheets support some. ‘Big-tech’ attractive new recession defensives. ‘Disruptive’ tech is much more vulnerable. |

| Defensives | More attractive as macro risks rise and bond yields better priced. Consumer staples, utilities, real estate attractive defensive cash flows, less exposed to rising economic growth risks, and robust dividends. Offset impact of higher bond yields. Healthcare most attractive, with cheaper valuations, more growth, some rising cost protection. |

| Cyclicals | High risk cyclical sectors – like discretionary (autos, apparel, restaurants), industrials, energy, materials, and small caps – have cheap valuations, many with depressed earnings, and have been out-of-favour for many years. But they are significantly exposed to rising recession risks. Some especially cheap (energy) or see growth recovery (airlines). |

| Financials | Current stresses likely individual not systemic. Post GFC reforms boosted capital and size/speed of authorities response. But outlook for 1) less GDP growth, 2) lower bond yields and interest rates, and 3) valuation sensitivity after recent surprises, worsens outlook. Insurance and Diversifieds (like Berkshire Hatheway) more defensive. |

| Themes | Dividends and buyback themes attractive with resilient cash flows, rising pay-outs, and investor search for defensives. Power of compounding dividends under-estimated, at up to 1/2 of total long term return. Small caps pressured by rising recession risk. Secular growth of Renewables and Disruptive Tech investment themes. |

| Traffic lights* | Other Assets |

| Currencies | USD ‘wrecking ball’ driven by Fed interest rates and ‘safer-haven’ bid. DM currencies hurt by still low interest rates and struggling growth. Strong USD hurt EM, commodities, US foreign earners like tech. But helps big EU and Japan exporters. See a stabler USD outlook in 2023 as near top of the Fed cycle and global risks remain high. |

| Fixed Income | US 10-yr bond yields supported around 4% by higher Fed rate hike and stickier inflation expectations. Set to ease as recession risks slowly build and inflation expectations gradually fall. US has wide spread to other market bond yields, and headwinds of high debt, poor demographics, and low productivity. 5% bill yields an attrative cash alternative. |

| Commodities | Strong USD and rising recession fears hit commodities. But still above average prices helped by GDP growth, ‘green’ industry demand, supply under-investment, recovering China, Russia supply crisis. Oil helped by slow return of OPEC+ supply and Russia 10% world oil supply problems. But commodities not to repeat their 2022 performance leadership. |

| Crypto | Potential ‘surpsise’ after dramatic and early asset class sell-off and later specific risk events from Luna to FTX. See long term asset class development with small size $1 trillion, correlations low, regulation growing, development/catalysts continuing – Ethereum merge to proof-of-stake and coming BTC halving. |

| *Methodology: | Our guide to where we see better risk-adjusted outlook. Not investment advice. |

| Positive | Overall positive view, and expected to outperform the asset class on a 12-month view. |

| Neutral | Overall neutral view, with elements of strength and weakness on a 12-month view |

| Cautious | Overall cautious view, and expected to underperform the asset class on a 12-month view |

Source: eToro

Analyst Team

| Global Analyst Team | |

| CIO | Gil Shapira |

| Global Markets Strategist | Ben Laidler |

| United States | Callie Cox |

| United Kingdom | Adam Vettese Mark Crouch Simon Peters |

| France | Antoine Fraysse Soulier David Derhy |

| Holland | Jean-Paul van Oudheusden |

| Italy | Gabriel Dabach |

| Iberia/LatAm | Javier Molina |

| Nordics |

Jakob Westh Christensen |

| Poland | Pawel Majtkowski |

| Romania | Bogdan Maioreanu |

| Asia | Nemo Qin Marco Ma |

| Australia | Josh Gilbert |

Research Resources

Research Library

eToro Plus: In-Depth Analysis. Dive deeper into market insights: Read daily, weekly and quarterly summaries, catch up on the latest market trends and get the most recent, in-depth overview of markets.

Presentation

Find our twice monthly global markets presentation on the multi-asset investment outlook.

Webinars

eToro CLUB members can join our live Weekly Outlook webinars every Monday at 1pm GMT. Also see the other online courses and webinars.

Videos

Subscribe to our timely video updates on market moving events, and the ‘week ahead’ view

Follow us on twitter at @laidler_ben

COMPLIANCE DISCLAIMER

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.