OVERNIGHT: A peculiarity of modern markets is the vast majority of long-term S&P 500 returns coming in overnight trading, when many earnings and macro reports are concentrated. Rather than in the better-known and more liquid day session. This ‘overnight effect’ is also seen in other big markets, from Canada to Hong Kong, and seems especially strong in assets most-owned by retail investors. Though this phenomena is tough to cost-effectively replicate and has performed less well recently. Possibly because 1) it has become better known, 2) with more firms offering out-of-hours trading now, and 3) overnight news from China and Europe being recently poor.

TRADING: Overnight trading is different from the regular session. It is typically less liquid and more volatile. This makes replicating the ‘overnight effect’ difficult, with higher trading costs and stock turnover. This saw the quick closure of the ETF (NSPY) set up to replicate it. But overnight trading does give the chance to react to out-of-hours earnings, like last week’s Meta (META) and Tesla (TSLA) results, or macro data, like last Friday’s big US jobs report. And may be more convenient for retail investors day jobs. This may have driven the phenomena’s size and resilience in retail-investor dominated assets like Tesla (TSLA), Grayscale Bitcoin (GBTC) and GME (GME).

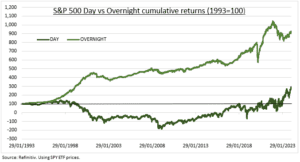

DATA: Cumulative S&P 500 index overnight price returns, proxied by the long running SPY ETF, have been 800% compared to the 200% returns during the traditional trading day (see chart). This compares the change from the prior days close to the current days open. It is only recently that the day-time 9.30am to 4pm trading day return has been positive. We repeated this analysis across the ten oldest ETFs. A similar overnight outperformance trend was seen in a majority of them: US midcaps (MDY), Canada (EWC), Mexico (EWW), Hong Kong (EWH), and Singapore (EWS). but not in the UK (EWU), Japan (EWJ), Germany (EWG), or Australia (EWA).

All data, figures & charts are valid as of 05/02/2024.