BEHAVIOR: Investors are often assumed to be fully rational, and markets to have efficiently priced everything. Market reality and the rise of behavioral economics argues it’s more complicated. Our latest retail investor survey, of 10,000 DIY investors in 13 countries from the US to Australia, shows we are all human. With personal experience and emotions playing a big part in investing. And many see investor sentiment and technical analysis more important drivers than the profits, valuation, and macroeconomic ‘fundamentals’. The survey also shows investors compensating these behavioral impacts, investing long term and saving regularly.

EMOTIONS: Our retail investor beat survey shows that personal experience and emotions play a significant role in investment decisions. 60% of the global survey said they had at least a moderate or strong impact, with very little deviation across the ages, incomes, or genders. Only 11% said it had no influence, on average, led by the Dutch, Danes, and Australians. Similarly, 51% confessed to being more cautious having lost money or seeing their investments decline, and 21% to then being less confident investors. By contrast 24% said it made them more resilient. Only 11% that it had no impact, with the cool-headed Dutch three times the average!

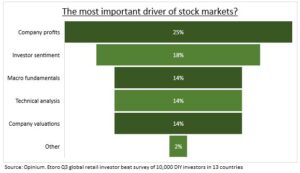

ANALYSIS: We asked retail investors what they saw as the biggest driver of stock markets. Company profits was the firm favorite, at 25%. Together with top-down macroeconomics (chosen by 14%) and company valuations (14%), a majority see the ‘fundamentals’ as driving markets (see chart). But it was a narrow beat. Investor sentiment was seen as the second biggest driver (18%), with technical analysis not far behind (14%). French investors saw sentiment as the most important driver, whilst Italian investors ranked technical analysis as top.

All data, figures & charts are valid as of 03/10/2023.