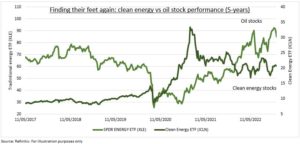

GROWTH: The renewables investment boom is increasingly strong and visible. It’s underpinned by the Paris Agreement goals to limit global temperature rise to 1.5 °C. And has been accelerated by the energy security focus after Russia’s invasion of Ukraine and its energy ‘weaponization’. This drove a big policy response, from the US Inflation Reduction Act to the REPowerEU plan. The International Energy Agency just raised its renewables outlook by 30%. This stronger growth combines with the tech-led valuation derating to make renewables a key investment focus for 2023, set to regain ground vs oil stocks (see chart). @RenewableEnergy.

OUTLOOK: The world is now set to add as much renewable power in the next five years as the prior twenty, according to IEA. 90% of new electricity capacity is forecast from renewables. Solar generation is seen tripling over next five years, and wind power to double. Investors are paying attention. ‘Clean-Tech is the most popular theme in our global survey. But this year has seen challenges. The market sell-off and higher interest rates took a toll on high valuation renewables stocks. High inflation and tangled supply chains made it tough to benefit from stronger growth.

CHALLENGES: Cross-winds are clearer looking at big renewables areas like electric vehicles, solar, and wind. Tesla (TSLA) price halved this year, despite growing profits 60%. This drove a valuation turn around from 130x P/E coming into the year to 30x now. Whilst wind stocks, from Orsted (ORSTED.CO) to Siemens Gamesa (SGRE.MC), struggled with rising costs. Market leader GE Vernova is now to be spun-off by its parent. Solar was a rare bright spot. Microinverter leader Enphase (ENPH) surged, posting 80% profits growth with 40% margins.

All data, figures & charts are valid as of 14/12/2022