WORRY: Markets typically worry. The day they don’t is when they are dangerously complacent. As worries get surmounted, without the world ending, markets typically grind higher. There is a particularly long list of market concerns right now. From higher oil prices and US bond yields to the UAW auto strike, and October 1st’s looming government shutdown and student loan repayment restart. Oil is the only one that keeps us awake, and even that is a short not medium term risk, and is ultimately self-correcting. Others like a time-limited auto strike and government shutdown look bad but may also be unconventional positives in cooling a too-hot US economy.

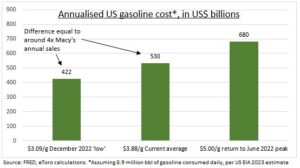

REAL: 1) Soaring oil is a real worry, and a double negative. The 25% gasoline price surge off recent lows has been a $110 billion tax on the US consumer (see chart) and risks stoking inflation expectations. But has yet to be realized, with retail sales strong and consumer inflation expectations falling. We also think the oil rally self-corrects as higher prices stoke conservation efforts and slowdown fears. 2) 15-year high US 10-year bond yields is a clear valuation headwind, with every 50bps increase cutting our S&P 500 fair value by 8%. But the yield move is not validated by proxies like inflation break-evens, still at 2.3%, or copper prices, still $3.7/lb.

UNREAL: Less concerning are the auto strike, government shutdown, and student loan restart risks, despite the big numbers. 3) The UAW strike is building and the auto sector 25% of all US manufacturing, given its long supply chain. 4) Federal spending is 25% of GDP and would be hit by the looming Oct. 1 shutdown. As would government reporting. What does a data-dependent Fed do with no data? 5) October 1 is also the student loan repayment restart, hitting 28 million consumers. Shutdowns and strikes have typically been short, whilst the Fed may welcome any slowdown these unconventional measures bring, with the Q3 Atlanta NOWCast a too-hot 4.9%.

All data, figures & charts are valid as of 20/09/2023.