Nomad Foods ($NOMD) is Europe’s leading frozen food company. Its ERP backdrop could be a yummy opportunity to get exposure to some household names in a robust and growing industry.

Key Highlights

- Nomad Foods is a portfolio company with strong brands in the frozen food industry

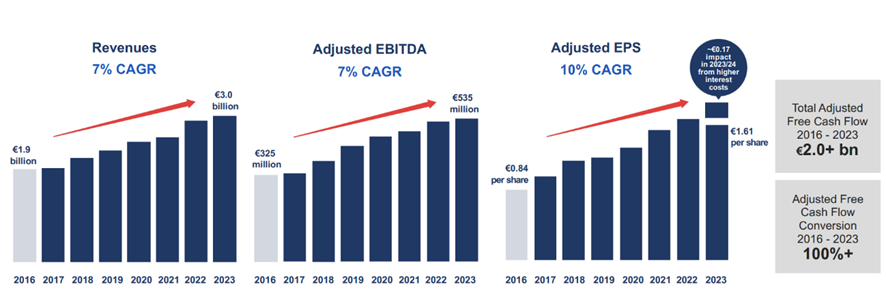

- Despite its transitionary ERP problems the company shows a strong growth trajectory

- Nomad Foods currently trades at a discount applying a conservative valuation model

The Business and the Industry

As Warren Buffett famously said, “Companies that have the top share of consumers’ minds have both pricing power and brand loyalty, which result in wealth creation for shareholders.” Nomad Foods is a perfect example. Growing up in an Italian household, Captain Findus fish sticks were always a staple in our diet—a remarkable achievement, considering how particular Italians are about food. This exemplifies the strength of Nomad Foods: a company that, through a series of strategic acquisitions, has built a compelling portfolio of household brands, now commanding 20% of the European frozen food market.

On top of Findus, formed in 1941 and marketed in Italy, France, Spain, Sweden, Switzerland and Norway, the other brands are household names with long histories and local heritage in their respective markets. The Birds Eye brand was established in 1922 and is primarily marketed in the UK and Ireland. The iglo brand, founded in 1956, has a longstanding history and is marketed in Germany and other continental European countries. Ledo (established in 1958) and Frikom (established in 1975) are the lead brands with strong heritage in south-eastern Europe.

Frozen food products are particularly attractive because they address important global food trends. Consumers increasingly prefer products that allow them to prepare meals quickly and with confidence and expect products to be healthy and good value for money. In addition, consumers are increasingly focused on reducing food waste. Frozen food products can have all of these characteristics. They are easy to prepare, they reduce the need for artificial preservatives, they are often better value for money than chilled alternatives and they reduce waste at all points in the supply chain and also in-home (due to the long shelf life, and the ease of portionability).

Nomad Foods – Investor Presentation

Competition

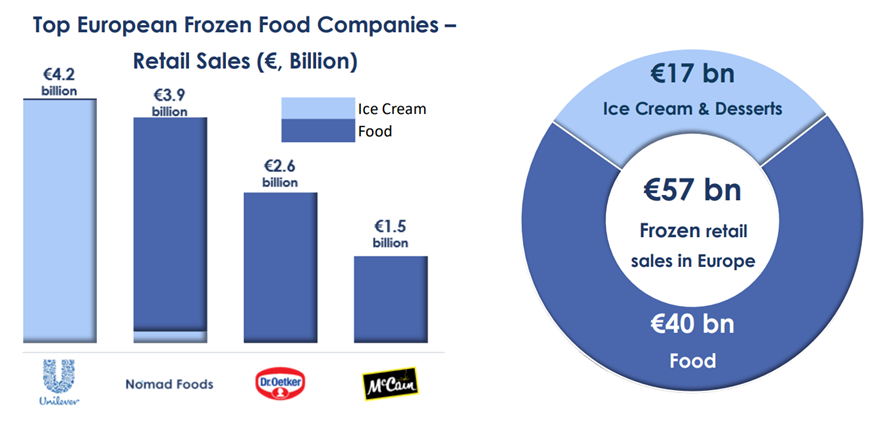

The main frozen foods producers in Europe are Nomad Foods, Unilever, Dr Oetker and McCain. Unilever commands the ice cream market with brands like Magnum, Ben & Jerry’s and Wall’s. Dr Oetker is famous for its frozen pizzas, while McCain is the most popular brand for frozen potatoes. There are also a number of private labels, like the supermarket chains, that offer low cost frozen products under their own brands.

Despite a competitive environment, Nomad Foods is active in segments different from its branded competitors, where it can command a superior market share. Nomad Foods product mix is heavily skewed towards protein and vegetables which account for 75% of its revenues. Its market share has laid the foundations of its competitive advantage. Indeed, Nomad Foods benefits from economies of scale, long-term retail relationships, and a diverse product and geographic mix. Its well-established brands give the company a strong brand equity strategy, with leading spontaneous brand awareness in several regions.

Moreover, the company has optimized its sourcing strategy. By operating a centralized procurement and supply chain aligned with its geographic footprint, Nomad Foods effectively reduces distribution costs. It sources products globally from a wide network of suppliers, minimizing the risk of over-reliance on any single supplier. Additionally, the company operates 18 manufacturing facilities strategically located near its main markets. This diversified manufacturing setup allows for better logistics management, balancing manufacturing costs with high customer service levels.

Nomad Foods – Investor Presentation

Market

The consumption of frozen foods is backed by clear secular trends. The consumption of frozen foods cuts down meal preparation, giving families back more time for what matters most. Frozen food is less expensive compared to their chilled equivalents. This matters for 93% of European consumers, who changed their way to shop to manage expenditures in a cost of living crisis. Finally, frozen foods are significantly more sustainable both for retailers and final consumers. Indeed, they allow to reduce waste for their significant longer shelf life.

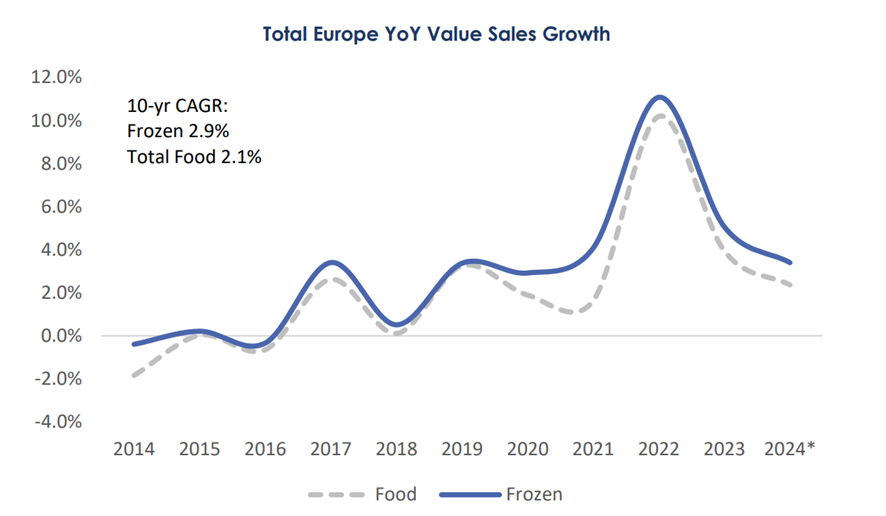

Over the last ten years the European savory frozen food market has grown around 3% while experiencing a huge spike in category demand throughout the COVID pandemic, driven by the aforementioned ability to address global food consumption trends. Furthermore, the amount of space that frozen food as a category occupies within the grocery retail environment is relatively stable due to the fixed amount of freezer space at the retailer that is not exposed to reductions in shelf space in favor of other categories or formats, as can be the case in shelf-stable parts of the retailer. Anyway, these other food categories grew only 2% in the same period of time.

Strategic Opportunities

Compared to their US counterparts, Europeans consume much less frozen foods per capita, favoring fresh options due to misconceptions about their poor quality. Per capita consumption of frozen foods in the US is 18.2 kg, while the European average is around 8 kg. Controlling for the dietary differences between European and US consumers, this trend is still significant and could narrow in the near future. This opens up compelling growth opportunities for European manufacturers.

Nomad Foods growth initiatives focus around strategic acquisitions, aimed at identifying and executing on attractive growth opportunities to consolidate their core product mix. Nomad Foods possesses solid acquisition expertise, supported by a strong management team and access to capital.

The company is also focused on its core product categories – fish, vegetables, and poultry – which account for 67% of its branded retail sales. Efforts to enhance these categories include improving product quality, refreshing packaging, and optimizing in-store execution through better product assortment, display strategies, and promotions. Given its current relatively low penetration at poultry and potato markets in European countries, Nomad Foods has much space for further growth.

Finally the company wants to increase margins and cash flows through disciplined cost management and supply chain optimization. This includes initiatives like lean manufacturing, factory footprint optimization, and enhancing procurement productivity, as well as developing stronger promotional programs, price architecture, and trade terms. Although over the past several quarters Nomad Foods’ profitability has been under pressure, margins remain stable and may increase in the future, providing more cash for distributions to shareholders.

Risks

Nomad Foods – Investor Presentation

There are some risks associated with a successful execution of Nomad Foods’ plans. For example, an increased consolidation in the frozen foods market might reduce the sales of the company. At the same time, an inflationary environment could reduce the ability of the company to pass through price increases to consumers. Anyway, the vertically integrated operations of Nomad Foods give it an edge in the complex pipelines of cold supply chains against its competitors as well as better price control capabilities.

Finally, Nomad Foods relies on sales to a limited number of large food retailers. The food retail segments are highly concentrated, with Nomad Foods’ top 10 retail customers accounting for about 32% of its annual revenue. Should these retailers perform poorly, the company’s business could be adversely affected. Despite this being a serious threat, Nomad Foods managed to increase its revenues each year over the last ten years, meaning that its sales channels and marketing capabilities can face various challenges.

Nomad Foods Valuation

But what is the value of Nomad Foods?

I will use the Residual Earnings Model to value the business, detailed in Accounting for Value by Stephen Penman (Columbia Business School Publishing, 2010). Some major benefits from using this model are the low number of inputs, low amount of speculation added and strict connection to the fundametals.

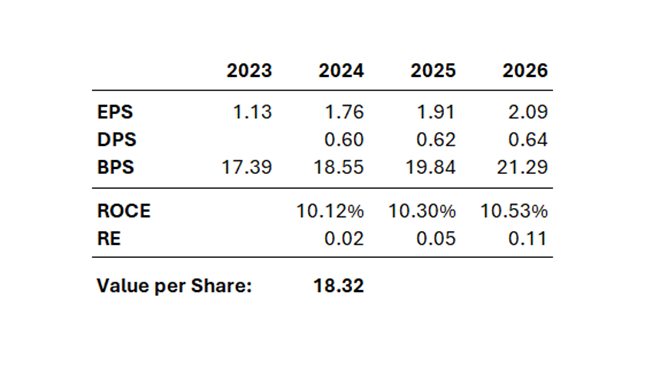

I will assume EPS of €1.76, €1.91 and €2.09 for FY 2024, FY 2025 and FY 2026. These are the most updated estimates of the financial analysts following the company. Plus, I will assume DPS (Dividend per Share) of €0.60, €0.62 and €0.64, in line with the company’s commitment. I will assume a 10% Cost of Capital, that is reasonable considering the current risk-free interest rates. I will also assume a 0% growth rate for the RE (Residual Earnings). This approach has two key benefits: it significantly reduces the risk of overpaying for growth and aligns with market theory, which suggests that residual earnings tend to diminish over time. Given a BPS (Book Value per Share) in FY 2023 of €17.39, we are now ready to compute the value per share of the company:

The BPS for FY 2024 and FY 2025 is computed adding the EPS and subtracting DPS from previous year BPS. We compute ROCE (Return on Common Equity) as the ratio of EPS and previous year BPS. The Residual Earnings are computed subtracting the Cost of Capital from the ROCE, allowing us to focus on the Economic Profits of the company. The result is then multiplied by the previous year BPS. Finally, we discount future Residual Earnings with a 10% Cost of Capital, assuming no growth for the future periods, and we add it to the base BPS.

As we can see the resulting value per share is €18.32, showing roughly a 17% premium from the current price of Nomad Foods. This valuation is highly conservatory, meaning that it would be sufficient for the company to deliver their commitments to see this appreciation reflected in the stock price.

Conclusion

The current ERP headwinds have led to a downward revision of guidance for the end of 2024. This follows a challenging period for the frozen food industry, marked by inflationary pressures and the cost-of-living crisis. Despite these difficulties, Nomad Foods not only maintained its profitability but also increased its revenues—an impressive testament to the company’s resilience and strength.

With its commercial flywheel gaining momentum and its business model supported by clear secular trends, the transitional challenges faced by this remarkable company may present an attractive opportunity for investors seeking exposure to a growing industry within the European market.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.