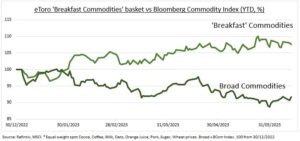

IMPACT: Commodities has been the worst performing asset class this year, after leading up for the prior two years. The 24-member Bloomberg commodities index (DJP) is down near 10%, led by plunging natgas and oil prices. But many smaller ‘breakfast’ commodities have bucked this weakness (see chart) and rallied near double-digits. Sugar prices are up by a third and orange juice is near all time highs. The culprit is supply shortfalls and weather disruption. This may worsen as a El Niño weather phenomena builds. This could pile further pressure on consumers already reeling from the dramatic supermarket food price rises of 7% in US, 15% in the EU, and 19% in the UK. These are well-above headline inflation rates and a headache for policymakers.

‘BREAKFAST BASKET’: Our equal-weight basket of eight popular breakfast items bucked the commodities down trend. Gains this year are led by sugar (+33%) orange juice (+24%), cocoa (+22%), coffee (+11%), and oats (+3%). This more than offset lower wheat (-18%), pork (-18%), and milk (-13%) prices. Sugar was boosted to an 11-year high by weather-disruption, and export restrictions, in no.2 producer India, alongside strong Brazil biofuel demand. Whilst orange juice prices are near all-time records after hurricane and disease damage to Florida citrus growers.

STOCKS: Major consumer food stocks, and especially ag-related stocks, have fallen this year. They’ve been hurt by broad commodity price uncertainties and high consumer price pressures. Ag stocks from fertilizers and crop protection Mosaic (MOS) and FMC (FMC), to equipment suppliers Deere (DE) and CNH (CNHI.MI), have been the worst hit. Major consumer food stocks like Nestle (NESN.ZU), Mondelez (MDLZ), and General Mills (GIS), have also underperformed stock indices as higher food prices have tested consumers wallets and triggered downtrading.

All data, figures & charts are valid as of 14/06/2023