SLUMP: Brent oil has borne brunt of global financial contagion fear. Its double-digit percentage price slump near matched that of the stricken banking sector recently. Contagion fanned existing GDP slowdown and oil demand fears. This has made commodities the worst performing asset class this year, after leading up in 2021 and 2022. We see tighter bank lending accelerating the global growth slowdown. But also the inflation fall and interest rate cuts. This may keep Brent in a new, lower price range. Help from a US strategic reserve rebuild or further OPEC+ supply cuts are unlikely. With hopes pinned on China’s reopening and the continued tepid supply response.

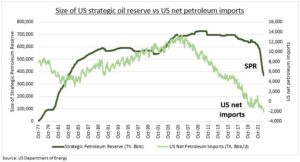

SPR: US Strategic Petroleum Reserve (SPR) sales are due to end in June. The authorities are already considering its rebuild. After selling 180 million bbls. in the past year, equal to nearly 2% global supply. They have highlighted a $67-72/bbl WTI price as attractive. We are there now. We see this as only a gradual process. They are always a slower buyer than seller. The politics balanced between the economic benefits of low prices and not having SPR insurance against future disruptions. The International Energy Agency requires the US to hold reserves equal to 90 days of imports. But with the US now a net exporter this is no longer a constraint (see chart).

OPEC+: They are taking a wait-and-see if contagion really impacts demand, and are unlikely to act fast. Their big 2.0mbpd cuts (2% supply) have only been in place since November and are due to run through 2023. They have an April 2nd advisory meeting but no full meeting until June. They see a robust 2.3mbpd of demand growth this year. Near all driven by China and emerging markets, and jet fuel and gasoline. With already very low developed market growth forecasts.

All data, figures & charts are valid as of 21/03/2023