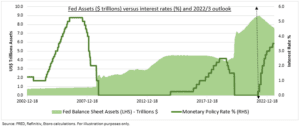

IMPACT: The Fed’s balance sheet is growing again. This is temporary, not a QE restart, and policy still tightening. The Fed was set up in 1913 to prevent bank collapses. It has only directly set interest rates since 1982. This dual role to maintain financial stability and to set monetary policy can sometimes seem to conflict. The Fed’s $300 billion of emergency liquidity to the financial system was seen as a restart of Quantitative Easing (QE), and boost to risk assets, by some. It’s not. See the UK example from October. On the contrary, US financial conditions are tightening and economic growth and inflation to slow down quicker. Yesterday’s 0.25% Fed hike was another step in this direction. Our 2023 investment view is now being turbo-charged.

NOT QE: The Fed expanded its balance sheet by $300 billion last week (see chart). By giving liquidity help to the financial system in return for collateral. This reversed the recent downtrend in the Fed’s balance sheet. But it is a tiny blip next to its $8.6 trillion size. And is 1) temporary banking sector support, 2) fully collateralized, and 3) will naturally reverse as the financial crisis eases and banks pay off these often pricey loans. It’s not a reversal of the $95 billion/month ‘Quantitative Tightening’ (QT) policy and Fed’s shrinking balance sheet. In fact it’s the opposite. By helping the banking system the Fed can compartmentalize and keep raising interest rates.

BOE EXAMPLE: This has happened before. In the UK’s October ‘mini-budget crisis’ when bond yields soared and the pension industry ran into distress. The Bank of England (BoE) made £20 billion of temporary bond purchases to ease market stresses. These were quickly reversed as the financial stresses eased and its Quantitative tightening (QT) policy started. Whilst the BoE continued to raise interest rates fast, from 2.50% to 4.00%, to combat its double-digit inflation.

All data, figures & charts are valid as of 22/03/2023