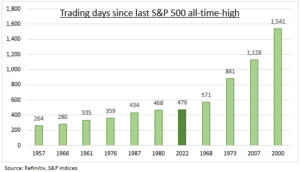

RALLY: The S&P 500 index is closing on its January 2022 all-time-high as we near its two-year anniversary, with both fundamental and technical drivers. It’s been a long time coming, with the current wait one of the longer (see chart), since the NYSE moved from working Saturdays to its five-day trading week in 1952. This 476 trading-day wait still lags the records set by the turn of the decade tech bust and 2008 global financial crisis. But we’ve come a long way from the -25% sell-off that bottomed last October, with the 21% return in the year since well ahead of the 15% average. Encouragingly, new highs beget new highs, with markets historically near always positive in the following six and twelve months. Our research shows technicals matter as much as fundamentals to many. Whilst the next big market structure change is move to T+1 in May.

MATTER: We asked retail investors what they saw as the biggest driver of stock markets. Traditional fundamental indicators like earnings and macro analysis only narrowly beat technical and sentiment indicators. Investor sentiment was seen as the second biggest driver (chosen by 18%), with technical analysis close behind (14%). French investors saw sentiment as the most important, whilst Italians ranked technical analysis as top. Company profits was the favourite overall, at 25%, followed by top-down macroeconomics (14%) and company valuations (14%).

T+1: A similarly important change to market convention as the 5-day trading week is coming May 28th when US cash equities settlement moves from a two-day to one-day (T+1) settlement. This has been progressively shortened from T+5 over the past forty-five years since the 1987 Black Monday crash. This will reduce the counterparty and margin risks highlighted by the 2021 meme stock boom and should boost market liquidity. But it will also put the US out-of-synch with much the rest of the world on T+2 and increase operational risk of failed trades in short term.

All data, figures & charts are valid as of 21/11/2023.