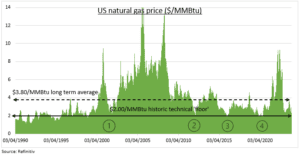

PRICE: US natural gas prices have continued to plunge and are now below $2.00/MMBtu. This has been a nominal price level seen only four times before in the past 25-years (see chart). And has acted as a ‘floor’ that triggers a lower supply, and higher demand, response. Natgas is the 2nd biggest constituent of the benchmark Bloomberg commodity index (DJP), after gold, and been a ‘widow-maker’ asset with its dramatic price volatility. The market is now in a ‘contango’ of higher futures, and US EIA forecasting higher average prices at $2.65/MMBtu this year, with the combo of slowing supply growth and ramping LNG export capacity. The risk/reward is finally looking up.

OUTLOOK: Prices have been driven lower by new production records, high inventories, and unseasonably warm weather sapping residential demand. This should gradually reverse in 2024. As weather patterns and lower prices see some residential demand normalisation, offsetting a slower economy and renewable share gains in industrial and electricity generation. Whilst LNG exports continue to rise, with significant +20% capacity additions coming late 2024 and early 2025. Even as later expansions are jeopardized by the Biden administration’s recent ‘temporary pause’ on new permits. Whilst current lower prices curb future supply growth.

CONTEXT: US is the world’s largest natgas producer, at 26% of total, as shale production has boomed. But the US is only 22% of global demand. This has made it the biggest LNG exporter, ahead of Australia and Qatar, and with significant new capacity coming. Whilst China (alongside Japan and Korea) has again become the world’s largest importer, European demand fell back last year with its economy struggling and storage levels high. Natgas stocks, from Devon (DVN) to EOG Resources (EOG), have outperformed the commodity meltdown as investors never saw $8+ natgas as sustainable, P/E valuations are now <10x, and shareholder return policies strong.

All data, figures & charts are valid as of 07/02/2024.