LESSONS: We are halfway through a strong third quarter S&P 500 earnings, but investors takeaways have been mixed. The US earnings ‘recession’ has ended, and the recovery is forecast to build from here. This balances the bond yield and oil price vice that has driven the stock markets recent ‘correction’. This combo has taken P/E valuations to below their 10-year average. The ‘tech’ sectors that dominate the market have reassuringly taken the earnings season lead. But the brutal reaction to profits misses shows expectations are high and investors unforgiving. And they are rewarding a profit margin driven earnings recovery less with revenues sluggish. Near 80% S&P 500 stocks have beaten expectations so far and all sectors ex energy.

MESSAGES: 1) High profits expectations and valuations led to earnings misses being punished twice as harshly as usual. By -5.2% vs a long term average -2.3%, per FactSet. 2) ‘Beats’ are being driven by higher profit margins, not the stronger revenues that markets would prefer. Net profit margin are up 40 bps to above average 12% led by lower inflation and cost cutting. 3) US economic ‘exceptionalism’ is driving much stronger domestic earnings than that from overseas. Domestic focused US companies grew earnings 7% vs 5% declines for those overseas focused.

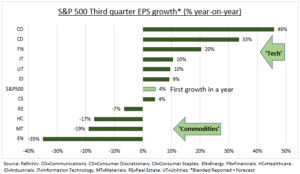

SECTORS: Earnings season has seen a sharp divergence between tech sectors growth leadership and with commodities lagging (see chart). The consumer discretionary, information technology, and communications ‘tech’ sectors have led both earnings growth and the proportion of beats. Even those perceived to have been poor. GOOG grew revenues 11% and operating profit margin by 3pp. META grew revenues 23% and doubled operating profit margin to 40%. Whilst energy earnings fell 40% and have been the only sector to miss forecasts, led by CVX and XOM. Hit by lower YoY oil prices and narrower refining margins.

All data, figures & charts are valid as of 30/10/2023.