RALLY: The 2023 ‘everything’ rally has been led by the big losers of last year, from crypto to disruptive tech. It’s been dismissed as a low quality ‘junk’ rally or a ‘dash for trash’ and seen as uninvestable. But is typical of the relief rally playbook as the fundamentals turn less-bad with sentiment depressed. All but the most risk-tolerant should fade this, and we prefer big-tech stocks. But there is still a method in the perceived madness. Disruptive tech valuations, proxied by ARKK’s largest holdings, have improved a lot. The median P/Sales is 5x vs 12x a year ago, and now in-line with NASDAQ. Half these stocks are forecast free cash flow (FCF) positive. And short interest ratios are high. At 5.5x they are 50% higher than Dec. 2021 and double NASDAQ.

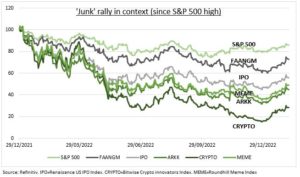

CONTEXT: We track some of these high risk equity market investment themes (see chart). They are up an average 23% since their end November 2022 lows. This rally is near 20 points ahead of S&P 500 and also ahead of big-tech. But they are still down an average 56% from end 2021 levels when S&P 500 peaked. We track ‘disruptive tech’ (proxied by the Ark Innovation ETF), recent IPO’s (Renaissance US IPO), meme stocks (Roundhill Meme), and crypto-related stocks (Bitwise Crypto Innovators). We compare versus big tech (FAANGM) and the S&P 500 index.

OUTLOOK: This so-called ‘junk’ rally has been driven by lower US bond yields and investor short-covering. And it comes against a back drop of depressed tech stocks after the 2022 rout. Despite their now less-bad valuations and cash flows, much of this rebound is still premature. Economic growth with keep easing. High interest rates restricting access to new capital. 10-year bond yield declines are likely done for now. And financial conditions already back to pre-Fed hike levels. The lack of industry M&A is a bottom-up warning on valuations and business cases.

All data, figures & charts are valid as of 07/02/2023