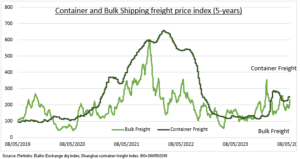

TRADE: Container and Bulk shipping rates are a fraction of pandemic shock levels but also well above their lows. The shipping industry moves 90% of global trade, making it a real-time barometer for the slow-burn global manufacturing and trade cycle recovery. This is being helped by US economic ‘exceptionalism’, China’s latest import and export recovery, and the outlook for Europe. Whilst Red Sea crisis impacts have proved less than feared and global supply chain disruptions are still low. But Red Sea impacts are proving longer lasting. This has all begun to turn the tide for container shippers, Maersk (MAERSKB.CO) to Hapag-Lloyd (HLAG.DE). Whilst the broadening stealth commodity rally helps the bulk shippers, from ZIM (ZIM) to Star (SBLK).

RED SEA: The number of ships transiting the Red Sea is down 50% year-over-year. Whilst those going the longer Cape route have tripled. This adds 6,000 km to journeys connecting Asia with Europe, and around two weeks to the journey time. The cost of shipping a standard 40ft container on the largest Shanghai to Rotterdam route is currently $3,100, down by a third from the end of January crisis peak. But still up a dramatic 150% in the past four months and seemingly stabilising at this level in a ‘new normal’ of higher container freight costs (see chart).

IMPACT: The continued simmering Red Sea disruption has been the latest vice of higher costs and delivery delays for consumer goods from the world’s Asia manufacturing hubs to consumers in Europe. Electronics, clothing, toys, furniture, and cars have been particularly hurt. Alongside time sensitive seasonal goods, like clothing, or just-in-time supply chains, like cars. This has thrown more sand-in-the-gears of a depressed global trade cycle. It further incentivizes the longer term trade trends. To costlier near-shored supply chains. And the expense of holding higher levels of inventories, to act as a buffer to what is just the latest supply chain shock.

All data, figures & charts are valid as of 09/05/2024.