NOW: Firming corporate earnings and a continued outlook for US interest rate cuts this year have propelled a strong May relief rally from April’s overdue pullback. This has taken the S&P 500 up near 30% from its October low. And delivered over an annual average index return in just the past five months. This momentum now faces a possible vacuum. With a long wait for Q2 earnings and later Fed rate cuts. This leaves the stock market vulnerable to rising political and seasonality risks. With one pullback behind us but an annual average of 3.2 and -14% intra-year drawdown. But fear-not. We still see mid-year catalysts and strong buy-the-dip technical support.

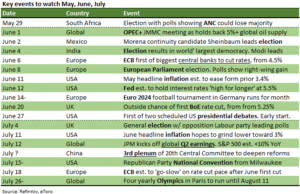

VACUUM: Markets now face a data vacuum on the twin earnings and rate cut pillars of this nascent bull market. NVIDIA (NVDA) ended Q1 results season on a high, but with six weeks now until JP Morgan (JPM) starts Q2 earnings season on July 12th. And its a longer haul until the first Fed rate cut penciled in for September 18th. With the next waypoint the June 12th FOMC (see table). Whilst volatility will rise as the US presidential kicks into gear with early presidential debates. And its significance thrown into sharper relief with July’s non-event UK election. And against the backdrop of weaker ‘Sell in May’ seasonality and the ‘Summer of sports’ distraction.

SUPPORTS: Overseas markets will drive near-term catalysts with support from a slow-burning technical ‘pain trade’. As ECB cuts interest rates June 6th and China’ July third plenum deepens stimulus. A drip-feed of US jobs, inflation, and PMI data should validate a goldilocks soft landing and inflation ease. On lagged effects of 5.5% rates, easing housing and healthcare, and the productivity boom. Our contrarian investor sentiment index is well off its March highs. A record $6.4 trillion in US money market funds. And year-end sell-side S&P 500 forecasts below market.

All data, figures & charts are valid as of 23/05/2024.