FIGHT: Interest rate cut hopes and lower long-term bond yields have triggered a big early-Santa rally. With markets now optimistically pricing five US rate cuts next year, starting at the March meeting. This is a frontal market assault on the Fed’s own published outlook, and they’ll be doubly unhappy financial conditions are now looser than when they started hiking rates. We fully expect a market reality check at Wednesday’s FOMC meeting, as the Fed pushes back with revised dot plot forecasts. But the market is justifiably less-afraid in taking on a data-dependent Fed. And we think the foundations are set for mid-2024 rate cuts and big rotation from defensive growth US and big tech stocks towards more rate sensitive assets, from real estate to Europe.

ROTATION: Regardless of short-term reality-check risks we think the course has been set. Of US and European rate cuts in mid-2024. That will trigger a wholesale country, sector, and style rotation. From the 2023 defensive growth ‘winners’ in the US and magnificent 7 big tech. Towards the 2023 ‘losers’ among interest rate sensitive, cheaper, and out-of-favour areas, from Europe to real estate. These are much smaller assets, and even a modest rotation could have an outsized effect. The US market cap is 4x Europe’s and tech is 10x the listed real estate sector.

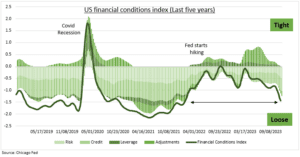

CONDITIONS: Markets need to be a little careful what they wish for. If they loosen financial conditions by too much, inflation could see an uncomfortable comeback and the Fed be forced to respond. The Chicago Fed national financial conditions index (see chart) is now at levels before the Fed started hiking in March last year. This has been led by its risk and credit components, most notably treasury and mortgage spreads and the lower VIX volatility index. The index is constructed so that zero represents the average financial conditions level since 1971. Currently a whopping 97 of its 105 variables tracked is looser than this long-term average.

All data, figures & charts are valid as of 06/12/2023.