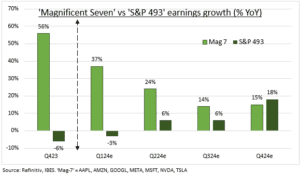

OUTLOOK: Five of the ‘Magnificent 7’ US big-tech stocks report earnings next week. With only Apple (AAPL) and NVIDIA (NVDA) later on May 2nd and 22nd respectively. They remain the most important drivers for another S&P 500 earnings upside surprise. Alongside less inflation-driven profit margin pressure, low analyst expectations, and the energy profits slump offset. And this earnings surprise is needed now more than ever. As the Fed rate cut catalyst is pushed back. Profits growth is slowly rebalancing away from big-tech. But they continue to do the heavy lifting for now. Accounting for 29% of S&P 500 market cap and est. to grow profits by 37% this quarter.

MAG-7: We saw a huge dispersion in big-tech price performance in Q1, led up by NVIDIA’s 80% gain. Whilst Tesla (TSLA) plunged by 30%, giving other ‘tech’ names Broadcom (AVGO), Visa (V) and Eli Lilly (LLY) now bigger market capitalisations. Yet the original group of seven still represents a near-record 29% of total S&P 500 market cap. And have driven over 60% of index returns in the past year. Last quarter they saw a 56% profits surge vs a 6% decline for the ‘S&P 493’ (see chart). This single-handedly saw the blue-chip index hit double-digit profits growth. Whilst six of seven have net cash balance sheets, led by Alphabet’ (GOOGL) $100 billion hoard.

Q1: Tech growth will be lower this quarter but still lead. Mag-7 profits are seen surging 37% vs a less-bad -3% fall for the ‘493’. Analysts have raised Mag-7 Q1 estimates 5% this year. Or double that if one excludes Tesla. NVIDIA is the AI ‘picks and shovel’ leader with profits seen quintupling. Amazon (AMZN) profits up an est. 170% on AWS strength and resilient consumer. Meta (META) profits est. doubling on the digital ad rebound and lower costs. Alphabet up 25% on the broadening ad recovery. Microsoft (MSFT) up 15% on AI adoption. Apple struggling +2% on the smartphone and China slowdown. Whilst Tesla est. -40% on production and pricing falls.

All data, figures & charts are valid as of 18/04/2024.