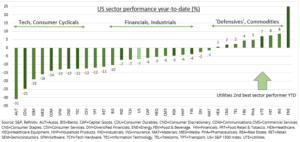

UTILITIES: We have seen a ‘stealth’ rally in utilities (XLU, @Utilities) stocks this year. They are only lagging the high-flying energy sector (see chart). This reflects a recent stampede by investors into traditional defensive sectors as rising recession risks more than offset surging bond yields that are usually a big drag on ‘bond proxy’ sectors. Many utilities also benefit from the boost to renewables, and higher power prices. Defensives are one end of our allocation ‘barbell’. But we prefer the cheaper, higher growth healthcare sector, with lower debt and regulatory risks.

DRIVERS: The global utility sector is dominated by US stocks NextEra (NEE), Duke (DUK), Southern (SO), Dominion (D). But with a big European component, like Iberdrola (IBE.MC), National Grid (NG.L), Enel (ENEL.MI). Some in the sector have been boosted by the improved renewables outlook (@RenewableEnergy), with the high oil and energy independence focus. But many are also hostage to higher input prices and rising risks of more heavy-handed state intervention to cushion consumers from soaring prices – see France’s EDF (EDF.PA) experience.

BARBELL: We see room for markets to move higher in Q2, with ‘less bad’ headwinds from Fed, Ukraine, and China. Often this is when some of the strongest returns can be made. Recession risks are overpriced. Earnings season to remind on earnings resilience. We focus on cheap cyclicals with near term growth, like energy (XLE) and financials (XLF). But we are structurally in a ‘new’ investment environment of lower returns and higher volatility. This argues for a ‘barbell’ balance of more defensives, like healthcare (XLV), ‘big tech’, and high dividend.

All data, figures & charts are valid as of 11/04/2022