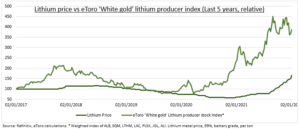

PICK-AND-SHOVEL PLAY: Lithium was the 2021 green commodities standout, up near 200%, and driving producer stocks (see chart). Electric vehicle (EV) battery demand surged, with supply tight given prior low prices. Supply is set to rise 30% this year, but demand will grow more. This should keep the market in deficit and support prices. 70% lithium is used for batteries, with c10kg for each EV. The sector profits outlook has tripled and P/E valuations a high 40x, but still a fraction of pure EV’s like Tesla (TSLA).

COMING SUPPLY: Lithium is produced from salt brines (South America’s ‘lithium triangle’, and China), spodumene rock (Australia), and geothermal (US, Europe). Surging supply is rekindling fears of the 2017-19 boom that saw major producers quadruple investment and drive a 50% lithium price fall. The difference now is strong EV adoption.

HIGH-FOR-LONGER: Demand is accelerating with EV adoption barely started. Also, new supply is higher up the cost-curve, supporting above average prices, and producer realised prices will rise as contracts catch up with spot. And not all the supply will arrive. Chile (30% of global supply) is limiting new licenses under its new leftist government.

WHITE-GOLD INDEX: Our index of seven major lithium producers has a total market cap. of $100 billion. It includes global leaders Albemarle (ALB), SQM (SQM), Livent (LTHM). Also Lithium Americas (LAC), Pilbara, and China giants Gangfeng and Tianqi.

All data, figures & charts are valid as of 06/01/2022