ALL-CONQUERING: The US dollar has conquered all this year, outperforming 85% of the 30 major global currencies we track. It has been boosted by the sharp re-pricing of Fed interest rate hikes (now with a 65% chance of starting in June) and the rebounding GDP outlook (Atlanta Fed NOWCast 8.2% growth for Q4). The Japanese Yen (JPY) is down 10%, Euro (EUR) 7%, and Swiss franc (CHF) 5%. All have dovish central banks, set to lag the Fed in hiking rates. Only China (CNH), Canada (CAD), and Russia (RUB), have outperformed. The stronger USD is a modest headwind for emerging markets, commodities, and US tech, but a silver lining for UK, European, and Japanese stocks.

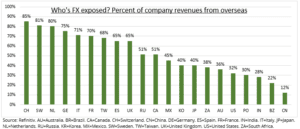

IMPACTS: A stronger USD hurts emerging markets (EEM), by tightening USD financing conditions and raising debt pressures. Also commodities (DJP), which are priced in USD and become more expensive for foreign buyers. And US sectors with large foreign sales, such as IT (XLK) with 57% revenues from overseas. The last two segments have been relatively immune to the USD. They have strong fundamentals and the recent USD rally is small. It is up 8% from its lows, half the 2018-20 rally and quarter 2014-16.

THE WINNERS: The flip side is weaker local currencies. This helps stocks (see chart) with big overseas revenues. They become more price competitive. This helps the UK (ISF.L) and Europe (EZU), for example, with many global-focused stocks. Also the many low-margin and global Japanese stocks. By contrast, China sells very little to the world.

All data, figures & charts are valid as of 18/11/2021