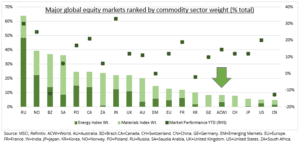

BIG PICTURE: Materials and energy are two of the smallest global equity sectors. This is held back by the ‘big 3’ markets (see chart). US, Japan and China are 70% of global equities. But the blistering commodity rally has driven a lot of commodity-centric equity markets like Russia and Norway. But there have been exceptions like Brazil and South Africa. Whether due to focus on the ‘wrong’ commodities like iron ore (-27% YTD) and gold (-6%), or respective political problems and stronger FX. Currencies have also been impacted, with CAD and RUB among the few to beat USD this year. But large commodity importers like JPY and KRW have been weak.

ENERGY: We think energy stocks should do better, even as the top sector performer this year. They have uniquely lagged physical oil by 10% this year, and futures are backwardated (lower). They should outperform with their operating leverage, as steel, copper, agriculture have, by 50%. Valuations are already cheapest of any sector, as investors grapple with ‘terminal value’ problem. How to value an industry that may not exist in the future. See smart portfolio @OilWorldWide.

DRIVERS: We see higher-for-longer prices as the commodity cycle lengthens, with cyclical demand staying robust, structural ‘green demand’ accelerating, and investment struggling to catch up. Potential ESG ‘orphan’ sectors, like oil, will use the strong cash flows today to pay big dividends (currently 5%) or fund a renewables pivot (and get rewarded). The BAML institutional investor survey shows commodities as the largest overweight. We think this can go higher. The base is very low, with commodity sectors a 8% global sector weight, near half only 5 years ago.

TODAY: Flash October PMIs a timely snapshot of growth momentum in Australia, Japan, Europe, UK, US. Consensus for stable and robust 55 levels everywhere other than weak Japan.

All data, figures & charts are valid as of 21/10/2021