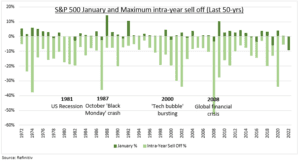

JANUARY? There are many bearish stats on what this terrible start to year can tells us about the rest of the year. Ignore them. The ‘January Barometer’ says ‘as goes January, so goes the year’. Meaning the performance in the first month of the year determines the full year. This was popularized by Yale Hirsh, the creator of the Stock Trader Almanac way back in 1972. He is partly right. In the fifty years since 1972 a positive January has led to a positive year 58% the time. But a down January only equals a down year ⅓ of the time. The reality is big sell-offs can happen any time (see chart). We remain positive on 2022.

DATA: The S&P 500 has fallen 13 times in January the past fifty years, or 26% the time. But has only gone on to close the year negative four times, or 13%. These were the 1981 US recession; 1987, which saw the ‘Black Monday’ crash; 2000 start of tech bubble burst; and 2008 global financial crisis. We do not see the ingredients for a crash or recession. The most recent comparison, 2019’ 6% January fall, ended with a +15% year.

VIEW: We are positive equities, with room for a double-digit annual return, focused on cyclical sectors and international markets. The Fed was as hawkish as expected yesterday, and markets fully priced for five hikes this year. High valuations are supported by record company profitability and still-low bond yields. Earnings forecasts are too low. Q4 profits have beaten consensus by 5% so far. Investor sentiment is also at attractively poor levels.

All data, figures & charts are valid as of 26/01/2022