FED DAY: The Fed meeting looms large, with a coming hawkish pivot away from its super-sized $8.7 trillion balance sheet and zero interest rates. ‘Don’t fight the Fed’ is a well-known mantra. Many will not want to stand in the way of this process. We are more positive. Much has been discounted. Other Central Bank tightening’s are reassuring. Our ‘fair value’ P/E supports high valuations. Protection is available in our favoured lower valuation sectors, like energy (XLE) and financials (XLF), or ‘new defensives’ big tech.

ROOM FOR RELIEF: Markets expect a doubling of the Fed’ planned bond purchase tapering, from $15 billion/month to $30bn. The Fed’s current $120bn monthly purchases would fall to zero by May. This is when markets are pricing an interest rate lift-off, and near three rate hikes by end of year. This may see a ‘relief rally’, like last week when the inflation report came in at a 40-year high, but crucially no worse than expected.

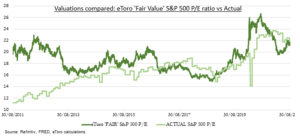

WHY MATTERS: We use bond yields, corporate profitability, and long-term GDP growth to form a ‘fair value’ S&P 500 (SPY) P/E. This is 21x, high vs history but close to current level. We see gradually higher bond yields offset from still high corporate profitability and GDP. A 0.5% US 10-year bond yield rise would cut our P/E by 10%. A return to the long term GDP outlook a decade ago (2.6% vs 1.9%), would raise it by 20%.

TODAY: Global PMI reports start as health-check on GDP growth (and earnings) outlook as virus fourth wave builds. We see resilience around expansionary 55 levels, led by US.

All data, figures & charts are valid as of 14/12/2021