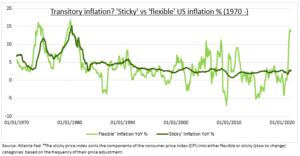

NOW WHAT: Q3 earnings have reminded so-far that growth is strong and companies offsetting cost pressures. The ‘wall of worry’ has eased, from China property to US tax rises. New all-time-highs have cut the overly bearish narrative. The inevitable question is what now? Investor worries still remain high, from Fed tapering (Nov. 3) to a new debt ceiling (Dec. 3). The VIX futures curve is steep. Inflation risks (see chart) are overdone, Fed tapering well-priced, and GDP to re-accelerate. Our 2022 S&P 500 target is +11%.

TAPERING COMING: Fed to announce accelerated tapering of its $120 billion/month bond purchases next week, with aim to complete by mid-2002, prior to its first-rate rise. This is well-priced and the market has been waiting months for. They may well act with relief. Canadian equities fell under 1% after yesterday’s double-shock on QE and interest rates. We think betting markets are rightly relaxed on a US December debt ceiling raise.

POSITIVES: Earnings forecasts are far-too-low. We see revenue momentum outpacing margin pressures. 2022 consensus is for only 8% growth, just above nominal GDP. Low bond yields and the high-tech weight will keep valuations above average. Stagflation and Fed hike concerns are overdone. Year-end seasonality is strong. Sentiment eased, cash levels are high. Buybacks (+50% yoy) and retail (households 41% in equities) resilient.

TODAY: Q3 US GDP growth expectations collapsed under high covid cases and supply bottlenecks. Atlanta Fed ‘NOWcast’ is +0.2% down from 6%. We see rebound from here.