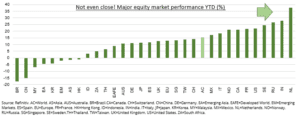

DUTCH DELIVERANCE: Holland (EWN, AEX) is the best performing major market this year (see chart), 10pp more than the 2nd performer. On the face of it the driver is clear. Dominant local semi stock ASML is up 75%. But the outperformance speaks to broader themes supporting our bullish European (EZU) view: 1) overlooked European tech, 2) Holland as a new tech listing hub, 3) strong global revenues, 4) a banks recovery.

TECH FOCUS: European tech is the unsung outperformer this year, and trading at some of the highest valuations globally. This reflects both its relative scarcity premium, and lack of legal headwinds. Start Up nation Holland has also turned itself into a tech listings hub, both locally and foreign, including payments Adyen (ADYEN.NV), investor Prosus (PRX.NV), Just Eat (TKWY.NV), Poland’s InPost and Spain’s Allfunds. Other Dutch unicorns chose US, like search solution Elastic (ESTC) and last week DevOps GitLab.

LESS FASHIONABLE: Holland has also benefited from the strong global GDP and trade recovery. 80% Dutch corporate revenues come from abroad, the 3rd highest of major markets and double the average. Not surprising with its small population and heritage. The bank’s rally has also helped. Biggest bank ING (INGA.NV) is up 70%, vying with ASML, helped both by higher bond yields and recently relaxed capital distribution rules.

TODAY: Vaccine-leader Pfizer (PZE) seen reporting a 80% profits boost versus last year. Vaccine revenues are over 40% sales, and helped by recent approval for use in children.

All data, figures & charts are valid as of 01/11/2021