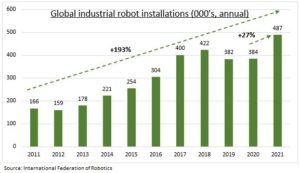

PRESSURES: Lack of workers and rising wages are boosting structural growth of automation and robotics to boost productivity. This is a key driver of company’s strong investment spending, especially with offshoring now more difficult, as seek to defend high profit margins. Industrial robot installations, for example, have tripled the past decade, grew 27% last year, and in US by 28% in Q1 this year. The automation, robotics, AI industries are another segment seeing a silver lining of current macro pressures, like renewables and EV’s, despite the tech valuation collapse.

STRUCTURAL: Falls in working age population growth, especially in developed markets and China, was already driving a structural shift to automation. The population proportion aged 15-64 peaked at 66% near a decade ago. Studies show long term over 50% of current food, bev and retail staff could be displaced. These sectors have a combination of 1) high employees/sales ratio, 2) lower profit margins, and 3) are seeing some of the strongest wage increases today. By contrast, areas like tech and healthcare have the opposite characters and may be less exposed.

INVESTMENT: The rush to automation has many investment facets. Industrial robots look set to keep growing fast, from current 110 per 10,000 workers, and to broaden from focus on auto industry. Japan (EWJ) and China (CQQQ) dominates the value chain here. 5G is a big enabler of automation, and is focus of @5GRevolution, and Defiance Next Gen Connectivity (FIVG). ARK autonomous tech & robotics (ARKQ), has a holistic view, with Tesla (TSLA), Trimble (TRMB) its largest stocks. Robotic process automation business, like UiPath (PATH) are a further facet.

All data, figures & charts are valid as of 09/06/2022