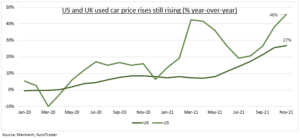

SOARING: Used car prices continue to hit new highs led by vans and SUVs. The market is still unbalanced, extending the bullish price cycle. This is boosting car dealers, leasers, rentals, as well as inflation. Covid and chips shortage restricted new car production, whilst cashed-up consumers boosted demand. The US Manheim used vehicle value index is up 46% vs this time last year. The UK AutoTrader price index up 27%. Both records and outpacing new car prices. These rose 13% the past year in the US, to $46,000, with buyers paying average $800 over list.

IMPACTS: Auto retailers like CarMax (KMX), Penske (PAG), AutoNation (AN), and Europe’s Inchcape (INCH.L) benefit from higher new and used prices and less sales discounts. Lenders like Ally (ALLY), Credit Acceptance (CACC) from higher collateral and lending values. Car rentals Avis (CAR), Hertz (HTZ), SIXT (SIX2.DE) all sold car inventories to match demand and raise cash, but also benefit from rare pricing power and access to new car inventory given their relationships. Manufacturers like General Motors (GM), Ford (F), Toyota (TM) benefit from higher new car prices but lower customer loyalty. This is all boosting inflation. New and used car prices have a 7% weight in the US consumer price basket and made up to 1/3 the index increase.

FORECASTS: Estimates are for 75 million global light vehicle sales this year, flat versus 2020, and a 10% rise next year. This is led by 17% gains in Europe to near 19 million units, which would benefit the top three makers: VW (VOW3.DE), Stellantis (STLA.US), Renault (RNO.PA). See @AutoIndustry. The US is set to see similar gains, to a lower 15 million units. China, the world’s largest car market, at 24 million units, is seen up only 5% after its stronger 2021 growth.

All data, figures & charts are valid as of 07/12/2021