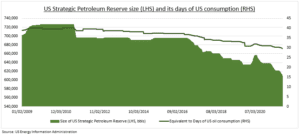

RISKS: Brent crude is -8% from $86/bbl to $79 on rising virus cases and talk of a Strategic Petroleum Reserve (SPR) release from US, China and others. US has 600 million bbls in its SPR (see chart), and falling. This is equal to 6 days of global demand. Major economies overall have 1.5 billion bbls, or 15 days demand. Risk is a SPR release will backfire and lead to higher prices. Being seen as short-term and desperate, with little follow-through given the relatively small SPR’s and their use-case for ‘real’ emergencies.

HISTORY: We have seen 3 global oil sales before. In 1991 (Gulf war), 2005 (Hurricane Katrina), and 2011 (Libya disruption). The largest was 60 million barrels, well under one day global demand. The US has moved alone 12 times, the largest being 10 million bbls. China, the world’s largest importer, sold 7 million bbls for the first time in September.

OPEC: The SPR threat has achieved its aim already, with prices plunging and OPEC warned. But actually selling is perilous. The SPR’s are small, sales have been ineffective, and OPEC little room to pump more (and may pump less to offset SPR sales). Demand is recovering and new oil investment is a fraction of historic levels – part due to the carbon transition. This is a recipe for high-for-longer prices, helping XLE and OilWorldWide.

TODAY: November global PMI is in focus. Whether rising virus cases will hit Europe’s outlook. PMI is seen as a stable 54. UK and US similarly seen stable, at a high 58 levels.

All data, figures & charts are valid as of 22/11/2021