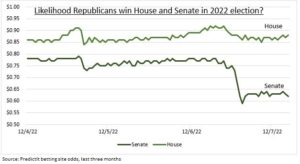

IMPACT: US midterm elections are in four months. Polls show Republicans win back the House of Representatives and maybe Senate control in a Congressional clean sweep. They benefit from traditional anti-incumbent party sentiment, President’s low approval, and inflation concern. This may further gridlock US politics and raise policy risks if the country falls into recession and bipartisan fiscal help needed. Down ballot initiatives will be important for many. We see a traditional post mid-term market bounce being accelerated by lower inflation and a peaked Fed.

MID-TERMS: Voters go to the polls November 8th, near midpoint of president’s four year term, to elect the 435 seat House of Representatives, a third the 100 seat Senate, two-thirds 50 State governors, plus direct ballot initiatives to change state policies – like marijuana (Maryland, South Dakota), sports betting (California), and crypto. It’s also seen as referendum on the incumbent, whose party generally loses seats, and is not helped by the President’s 56% disapproval rating.

MARKETS: The months leading to mid-terms tend to be poor for equity markets, but are usually followed by relief. This may now be super-charged. It will align with the easing inflation and end of Fed rate hikes we expect to boost global markets. Also with the traditional positive year-end seasonality. This year’s poor performance had little to do with politics, and everything with high inflation and Fed. Legislative action has been long hamstrung by congress divisions, between and within the two parties. This has seen policy, from green initiatives to tech oversight, stalled.

All data, figures & charts are valid as of 19/07/2022