THE ‘R’ WORD: US markets had a weak and nervous January. The Fed will raise interest rates and economic growth will slow. History says to buy this weakness unless we are heading for a recession (the ‘R’ word), and a market crash. The shape of the US yield curve is the best recession indicator to watch. It says risks are low, leaving outlook supportive. Investors have priced in 5 Fed hikes; earnings estimates are rising; valuations back below 20x P/E; and investor sentiment near attractive contrarian capitulation levels.

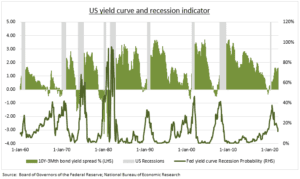

BEST INDICATOR: An inverted US yield curve, with 3-month bond yields above 10-year yields has predicted ten of the last nine US recessions (see chart). This is the best hit rate around. The Fed pushes up short term yields as it hikes interest rates, but the market pulls down long term yields as it worries on economic growth. We are well away from these levels, with the Fed indicator putting ‘R’ risks the next year at a low 15%. More broadly, despite near term omicron GDP weakness (Q1 GDP NOWCast at 0%), full year forecasts are for 3.8% this year and 2.5% next, both above long-term growth rates.

IMPLICATIONS: With US recession risks low it still pays to buy market pullbacks, and supports our constructive outlook. We are focused on cheaper segments and sectors, like energy and financials, and Europe and China. The yield curve indicator needs watching. As the Fed continues to force up short term yields it will flatten, and may worry markets.

All data, figures & charts are valid as of 02/02/2022