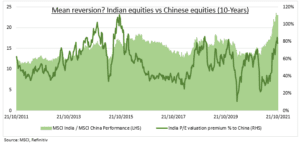

ASIAN GAP: It’s not just the US hitting new highs. India (INDA) is 2nd best performing market this year (+30%), on lower covid and re-allocations from China. Asian peer China (MCHI) is 2nd worst (-11%). This outperformance (see chart) has taken India’ valuation premium 20% over average, just as its big exposure to high oil and a tighter Fed is tested. It’s time to look again at China, with its tech-crackdown and slowdown risks well-priced.

INDIA: The world’s 2nd most populous nation, and 5th largest economy, is also the fastest growing. It has 9.5% GDP growth and earnings growth twice the global average. This is driving a catch-up, with GDP per capita 5x lower than China and 30x below the US. Its market is domestic focused. On banks (HDB, IBN) and consumer (TTM), and normally expensive, reflecting the growth. It also has globally competitive IT outsourcers (INFY).

CHINA: Has transformed from manufacturing-heavy state-owned stocks to consumer internet, led by Alibaba (BABA), Tencent (0700.HK), Meituan (03690.HK), JD.COM (JD.US). The world’s no.2 economy and largest commodity importer, remains hugely under-represented in global equities. The tech crackdown and growth slowdown is well priced. Policy support is set to rise. Valuations are a 30% global discount and growth still strong, with 5.5% GDP and 16% EPS next year. See themes @ChinaTech, @ChinaCar.

TODAY: IT has been a big Q3 surprise, with EPS beating forecasts by 18%, behind only cyclicals financials and industrials. This is remarkable given already high expectations.

All data, figures & charts are valid as of 26/10/2021