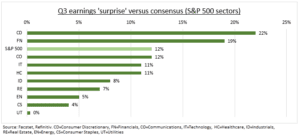

SO FAR: We are halfway through US Q3 earnings and it’s been all about ‘TIM’: Tech, international, and margins. Cyclicals have led, but ‘tech’ has been very strong, and every sector is ahead (see chart). International and Europe has led growth. Strong sales have outpaced cost-pressure and kept margins near all-time highs. This will drive increases to low earnings forecasts, and further market upside (or protection from lower valuations).

SURPRISES: S&P 500 earnings have beaten forecasts 12% and revenues 2% so far. EPS growth is +38% versus last year and revenues +15%. Discretionary and financials have led surprises, but communications and IT are close behind. This is remarkable given the strong growth and high expectations, and despite mixed numbers from Apple (AAPL) and Amazon (AMZN). Global growth is even more. Europe (EZU) set for 50% earnings growth, 16% over forecast. International-focused US stocks have led the domestic peers.

WHAT IT MEANS: Last quarter was peak earnings growth (+96%), but we see forward earnings expectations too low, as economic growth reaccelerates and profit margins stay resilient. Cyclicals (IWD), from energy to industrials, will be the greatest beneficiary, with their high earnings leverage. We see earnings growth twice consensus for next year.

TODAY: US National Retail Federation forecasts 8.5%-10.5% holiday spending growth, double average. Household balance sheets are strong and supply-shortages encourage a longer buying season. US consumer is the single most important global economic driver.

All data, figures & charts are valid as of 28/10/2021