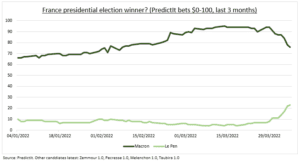

FOCUS: Markets are nervous and repricing the electoral odds in a tightening (see chart) French presidential election that goes to 1st round polls on Sunday. The stock market has outperformed European peers since pro-business Macron’s 2017 electoral surprise. A still overwhelming consensus Macron win could see efforts to address rising consumer costs, the number one voter concern, with more restrictions on power prices and introduction of food vouchers. Defence stocks have gained from support by all main candidates. A Macron win could help the EUR.

ELECTIONS: The election 1st round is April 10th and 2nd round April 24th. A Macron versus rightist Le Pen 2nd round is most likely, with Macron winning a tighter race than in 2017. Focus will also be on the subsequent June parliamentary elections to see Macron’s ability to implement his agenda. Political continuity in Europe’s 2nd largest economy and sole UN security council member is more important than ever. Alongside Germany’s new chancellor Olaf Scholz, France faces the Ukraine crisis on its doorstep and the rising headwinds to European economic growth.

MARKET: France’s market is dominated by global luxury stocks like LVMH (MC.PA), Hermes (RMS.PA), and Kering (KER.PA). Second is Industrials, with heavyweight Schneider (SU.PA), Airbus (AIR.PA), and Vinci (DG.PA), and defence names like Thales (HO.PA). Staples, like L’Oreal (OR.PA), and financials, like BNP Paribas (BNP.PA), are also well-represented. Like broader Europe valuations are undemanding, at 12x P/E, with decent 10% earnings growth. Most revenues come from outside France, making the weak euro an important competitive support.

All data, figures & charts are valid as of 06/04/2022