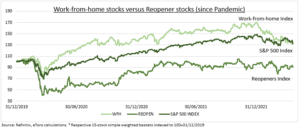

NOT JUST NETFLIX: Our ‘work-from-home’ (WFH) stock basket has slumped 23% this year, double the S&P 500 fall, and it has now given back all its post-pandemic outperformance (see chart). Netflix (NFLX) has been the recent poster child for this reversal but it is far from alone. WFH have seen a double-whammy as high earnings expectations have disappointed and high valuations have fallen sharply. The WFH basket is not out-of-the woods with earnings forecasts still 50% above pre-crisis levels and valuations still higher than the S&P 500, at a 19x P/E ratio.

SURPRISING SAFE HAVEN: Our ‘reopener’ basket is down 2% this year, supported by the combination of low expectations and reopening economies as lockdown restrictions ease. This has helped offset the travel and tourism exposure to surging oil prices. Reopeners have still underperformed the market 40% since the pandemic, have earnings less than half pre-pandemic levels, and normalized valuations below the S&P 500. This combination of still low expectations and more lockdown loosening remains attractive and a surprising ‘safer haven’. See @TravelKit. Reopeners are part of the cyclical side of our allocation barbell, with commodities and financials.

OUR BASKETs: Our 15-stock ‘Reopening’ basket includes airlines, cruises, car hire, hotels, casinos. From Boeing (BA) to Marriot (MAR). ‘Work-from-home’ basket is made up of gaming, home improvement, delivery, e-commerce, data centres. From Activision (ATVI) to Zoom (ZM).

All data, figures & charts are valid as of 25/04/2022