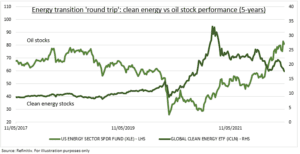

LONG HAUL: Renewables stocks saw a short green silver-lining from the Ukraine crisis, with surging oil incentivizing renewable transition and refocus on energy security. But sector, from global clean energy ETF ICLN to smart portfolio @RenewableEnergy, gave back gains as fossil fuel stocks stormed ahead (see chart). The renewables reality check is led by rising costs, slow moving regulations, and bond yield valuation pressure. This is disappointing, but investor support and long-term adoption is clear and valuations now inline with NASDAQ’s 4x P/Sales.

CHINA: Nearly half of all new renewables (solar, wind, hydro, biofuels) capacity came from China last year, followed far behind by Europe, then US, with uncertainty over tax incentives and solar import availability. There is a long way to go with only 25% global electricity supply renewable and barely started on 80% non-electrified usage, from transport to heating. Renewable disruption takes much longer than tech disruption, and the fully-loaded cost comparison murkier.

OUTLOOK: Renewable electricity capacity is expected to accelerate to 8% growth this year, to over 300GW for the first time. Rising freight and raw material costs have boosted renewable costs but not cut competitiveness, with fossil fuel prices rising even more. Surging natgas prices are setting marginal cost in many markets, allowing long term renewable contracts much lower than wholesale prices. The energy transition is accelerating, unstoppable, but not fast enough.

All data, figures & charts are valid as of 19/05/2022