MISSES: A strong Q4 earnings season saw S&P 500 profits up 31% and Euro Stoxx600’ +67%, a key market support. But we also saw many high-profile misses and big stock falls. Netflix (NFLX), Meta (FB), Paypal (PYPL), Roblox (RBLX), and on. ‘Beats’ were less rewarded and ‘misses’ more punished than usual. We have seen a strong profits run, so they are ‘expected’. US valuations are still high 19x P/E. Uncertainty reigns, from Fed to Russia. This makes earnings misses painful and underpins our focus on cheaper assets.

SECTORS: Both US and European utilities and industrials missed earnings forecasts. Soaring energy costs have impacted utility input costs, and supply chain issues have hurt industrials. The bigger stock price impacts have come from the high-flying tech stocks with the biggest impact from falling valuations rather than the lower earnings outlook.

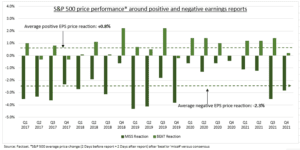

THE DATA: Investors reacted harshly to S&P 500 stocks that missed earnings forecasts this quarter (see chart). The average ‘miss’ fell 2.8%, above a five-year average -2.3% reaction. By contrast, the average ‘beat’ rose 0.2%, below the five -year average 0.8%.

RISK/REWARD: We focus on cheaper sectors, like Energy (XLE), Financials (XLF), and overseas markets, like UK (ISF.L), China (MCHI). They benefit from both stronger near-term earnings momentum and lower than average valuations. This gives better upside, but also reduces some of the high-expectations risk that makes stocks vulnerable.

All data, figures & charts are valid as of 02/03/2022